China Preparing for Turbulence during Trump's Second Term

China’s authorities emphasise their desire to maintain stable relations with the U.S. after Donald Trump takes office. However, they are preparing for a tightening of U.S. policy, including on trade and American support for Taiwan. To counter this, they intend to use the business ties to China of people with influence with Trump. Anticipated difficulties in U.S. cooperation with its regional allies may make it easier for China to act in the Asia-Pacific, including in cooperation with Russia.

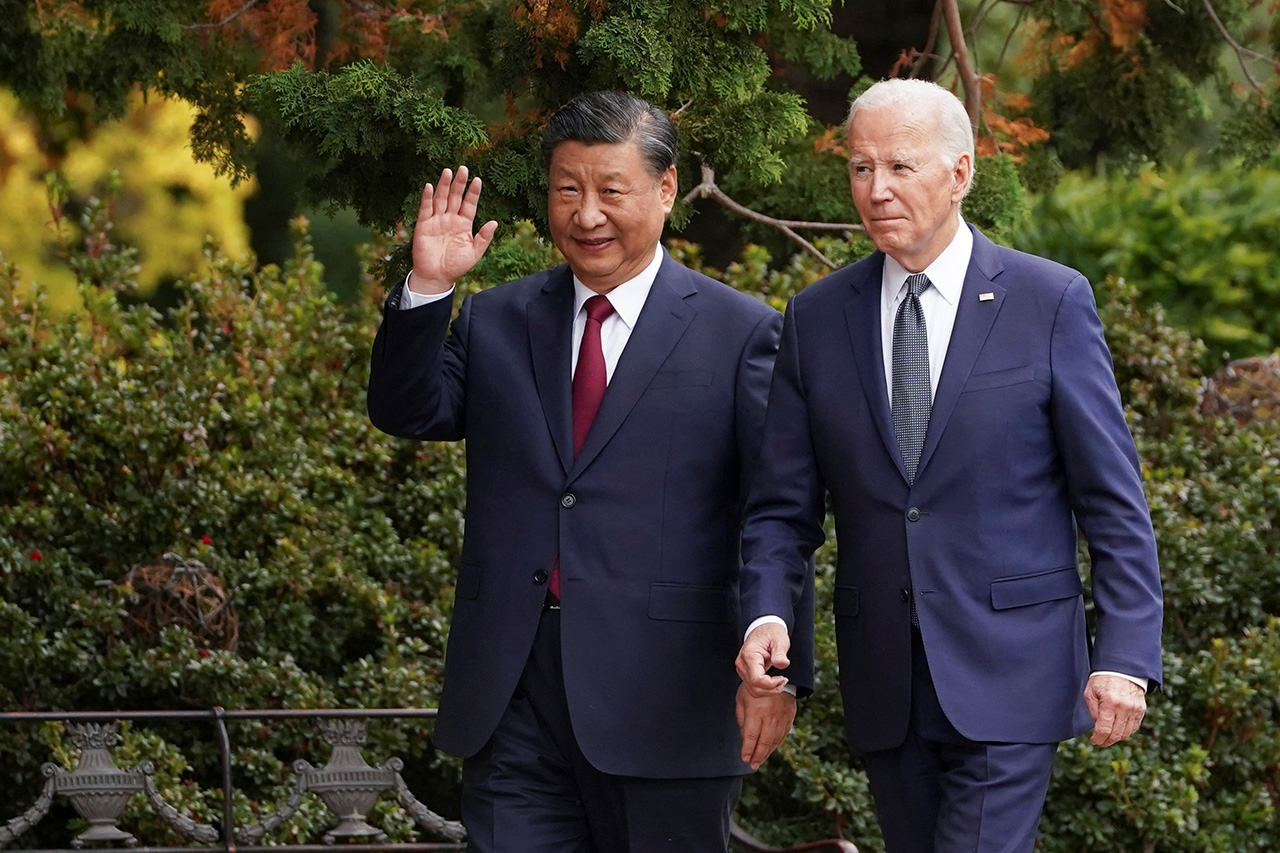

(1).jpg) Avishek Das / Zuma Press / Forum

Avishek Das / Zuma Press / Forum

U.S.-China relations are dominated by rivalry, primarily in the economic and technological dimensions. One element is China’s assertive policy towards Japan, the Philippines, and Taiwan, which are U.S. allies and partners in the Asia-Pacific. In 2023, communication between the U.S. and China improved, including the resumption of dialogue on military matters and the start of talks on Chinese restrictions on exports to the U.S. of ingredients used in the production of the powerful drug fentanyl. Last November, the leaders of the two countries, Xi Jinping and Joe Biden, met at the APEC summit in Peru. At the same time, according to U.S. sources, Chinese services were undertaking operations to influence the U.S. election by polarising American society. The Chinese authorities did not comment on the U.S. campaign formally, but among Chinese experts the prevailing view was that whatever the outcome of the election there would be no change in the “aggressive” U.S. policy towards China. It was hoped, however, that if Kamala Harris won it would not be accepted by Trump, and that the reaction of his supporters would lead to destabilisation in the U.S. On 7 November 2024, Chairman Xi Jinping congratulated Trump on his victory in a phone call, stressing the need to stabilise U.S.-China relations.

China’s Concerns

The prevailing belief in China’s power apparatus is that Trump’s second term will be less chaotic than the first, but that the unpredictability of the president’s decisions remains a significant element. In their view, this is borne out by the differences in Trump’s statements on new tariffs on Chinese goods, including his willingness to use trade instruments to achieve political goals. During the campaign, Trump announced that he would introduce tariffs of 60% on Chinese goods. Last December, though, he indicated that he would increase tariffs by just 10% on Chinese products temporarily at the start of his term, due to the involvement of Chinese companies in combating the fentanyl crisis.

The Chinese authorities speculate that Trump’s policy towards China will be more radical than that of the Biden administration, not least because of the support of many U.S. high-tech companies. The possible greater assertiveness of the U.S. towards China is also supposed to be evidenced by the president-elect’s designated candidates in the new administration: Marco Rubio for Secretary of State, Michael Waltz for National Security Advisor, or Elbridge Colby for the Undersecretary of Defence. Each of them sees China as the primary threat to U.S. interests and seeks to tighten policy towards it, including, for example, further restrictions on economic cooperation.

In order to counter the U.S. tightening course, China may agree to increase imports from it, as in the case of the so-called first-phase agreement of 2020. To not provoke Trump and in order to strengthen its own negotiating position, China has extended until the end of February this year the exclusion of certain U.S. products from the tariffs imposed in 2019 (decisions on this are made every six months). They are also careful in their response to U.S. export restrictions. For example, a decision by the Chinese Ministry of Commerce on 3 December increased controls on exports to the U.S. of gallium, germanium, and antimony, but only as part of military production. China also maintains its readiness to discuss the fentanyl issue and the general terms of cooperation between Chinese and U.S. companies. At the same time, it is seeking to accelerate the expansion of its own capabilities, for example, in the semiconductor, robotics, and artificial intelligence sectors.

China will seek to influence U.S. policy by restricting or facilitating Trump’s associates doing business in China. Among them is Jeffrey Yass, a Republican donor and investor in ByteDance, the owner of Tik-Tok (Yass has a 15% stake), whom Trump met with before the election. In December 2024, the president-elect spoke to the CEO of Tik-Tok in the U.S. and asked the Supreme Court to delay the entry into force of the ban on the app in the U.S. Others involved in business in China include Elon Musk (Tesla, Starlink, SpaceX). Tesla manufactures half of its vehicles in China and is waiting for approval from the authorities there regarding the development of autonomous driving technology. David Perdue, Trump’s nominee for U.S. ambassador to China has business experience in Hong Kong. Trump’s campaign sponsor and friend Steve Wynn, a casino owner, has business in Macau. Dana White, the owner of the UFC, a combat sports federation at whose events Trump campaigned, is bidding to host fights in China and may also be one channel of influence.

China expects rhetorically stronger support for Taiwan from Trump and his administration, although in practice it will be similar to the Biden administration’s actions in terms of military cooperation, arms supplies, and political dialogue. In response, China will continue provocations, military actions, and hybrid operations while accusing the Taiwanese authorities of destabilising the situation in the Taiwan Strait. China will also expand its military manoeuvres to include not only Taiwan’s neighbourhood but also the Western Pacific basin near Japan or the Philippines. The more frequent inclusion of Russian units in such exercises is also intended to signal its cooperation with Russia vis-à-vis the U.S. in the region.

Role of the EU

The Chinese authorities hope that the Trump administration’s transactional policy towards U.S. allies in Europe will complicate transatlantic cooperation. They emphasise that the rivalry with the U.S. in the Asia-Pacific is long-term and possible problems in EU-U.S. relations will not translate into a change in U.S. policy in the eastern region. However, they may, especially in the context of Trump’s declaration to bring a swift end to the Ukraine-Russia war, increase Russia’s ability to influence the West, which would be in line with the goals of Sino-Russian strategic cooperation. Therefore, China is consistently backing Russia by increasing pressure on EU states to support a ceasefire in Ukraine. Part of China’s actions include tacitly agreeing to the participation of soldiers from North Korea fighting on the side of the Russians, support for Russia’s war economy and army (e.g., it is most likely producing military drones for Russia in Xinjiang), and the involvement of Chinese-linked vessels in damaging critical infrastructure in the Baltic Sea.

The Chinese authorities realise that the EU and the U.S. policies may unite on China during Trump’s term. This is fostered by a sense of insecurity in the Union resulting from China’s economic policy and its cooperation with Russia. China reckons that Trump’s possible actions against the Union in trade policy (particularly acute for the German economy) and in the security sphere may hinder the development of a transatlantic approach towards China. In order to deepen the divisions between the U.S. and the EU, China will seek (in official contacts and through disinformation) to improve relations with individual EU Member States by emphasising its technological and economic potential and try to stop them from reducing their dependence on China (derisking). Suggestions of a greater opening of the market to EU companies, a return to the EU-China comprehensive agreement on investment , or the lifting of China’s 2021 sanctions, among others, are to serve this purpose.

Conclusions. The widespread perception among Chinese experts and policymakers was that no matter the outcome of the U.S. presidential election, it would not improve bilateral relations. However, Trump is perceived in China as less effective than Biden in implementing deterrence plans, for example, in expanding NATO in the Asia-Pacific or the effectiveness of cooperation with allies and partners in the region. China will portray the U.S. as a destabilising international actor (including by highlighting U.S. support for Israel in the war in Gaza and surrounding region). These activities are intended to strengthen China’s relations with countries of the Global South, such as in BRICS+ or the G20.

It will be crucial for the EU to identify common points in its relations with the U.S. regarding the threats from China and to identify possible actions in the context of, among others, the Asia-Pacific situation. These could include finding common ground on Chinese unfair trade policies, including in relation to e-commerce, but also data security, cybersecurity, military technology, and disinformation. Increasing the Union’s economic competitiveness and defence capabilities to respond to challenges from both China and Russia could strengthen its position in possible trade talks with the Trump administration. Raising such issues within the Union may be served by Poland’s presidency of the EU Council in the first half of 2025, for which security issues, including the strengthening of transatlantic relations, are a high priority.

.jpg)

.jpg)