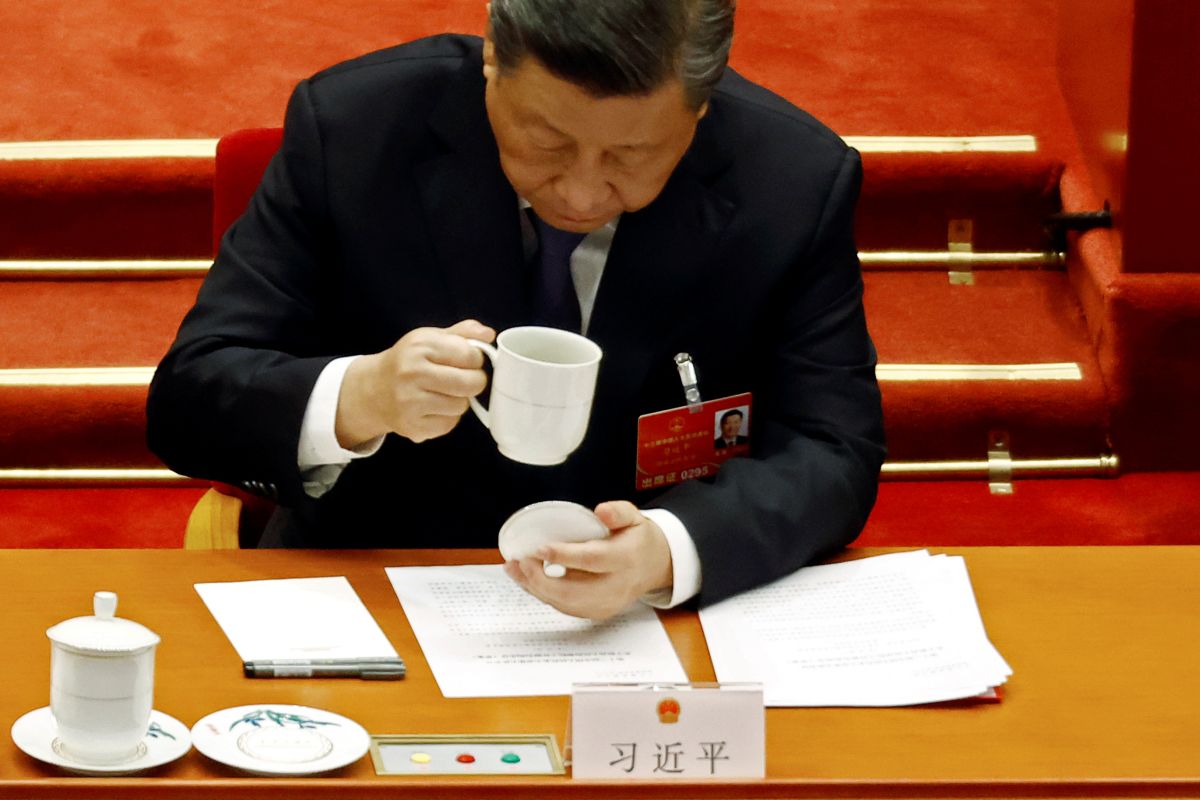

China Facing Challenges Ahead of 20th CCP Congress

The 20th Congress of the CCP, which begins on 16 October, will take place in the context of growing economic problems and an unfavourable international position for China. In addition to the poor outlook for economic growth and rising unemployment, the PRC is still struggling with a real estate crisis and rising energy costs. Combined with the growing rivalry with the U.S., this is resulting in China’s closer cooperation with Russia. The likely continuation of Xi Jinping’s rule after the congress will intensify these trends. It also implies a radicalisation of China’s attitude towards the EU.

TINGSHU WANG/ Reuters/ FORUM

TINGSHU WANG/ Reuters/ FORUM

On 30 August this year, the Politburo of the Communist Party of China (CCP) confirmed that the 20th CCP Congress will begin on 16 October. It marks the end of the second, five-year term of Xi Jinping as the secretary general, as well as the term of the Central Committee (CC), elected in 2017. Its participants will choose the next secretary general, the composition of the new CC and other party institutions. The convention will last more than a week and will bring together about 2,000 party members in Beijing. Immediately after it ends, a new CC will meet to elect the Politburo (25 people), including members of the Standing Committee (SC), the most important decision-making body of the CCP (currently seven members). The party will have to deal with the most serious internal problems and difficult international situation since the early 1990s.

Internal Challenges

The CCP authorities are struggling primarily with a difficult economic situation, exacerbated by the constant lockdowns imposed as part of the “zero Covid” policy. The indicators for the sectors that have so far been responsible for the development of the Chinese economy are weakening. Exports, which are still the basis of China’s economic growth, are lower than last year’s level, which is related to the worsening global economic conditions. The Chinese economy also is recording a low level of consumption (in 2021, it accounted for just under 40% of GDP) and high unemployment among young people (an increase from 16.8% in June 2020 to 19.3% in June this year). This translates into lower GDP growth forecasts—this year it may amount to only 2.8-3.0%, well below the target of 5.5%. Real estate sales are falling, mainly due to the difficult situation of borrowers. This causes a deterioration in the profitability of developers, despite the subsidies applied by the authorities and the reduction in August this year of interest rates by the central bank. The provinces where incomes have dropped are having problems with balancing their budgets and, on the orders of the central authorities, they are to increase investments, in particular in infrastructure. The financing is to be used by the issuance of special bonds worth more than $72 billion. Small and medium-sized enterprises in China are also expected to benefit from tax breaks—by the end of 2022, the cost is expected to be about $400 billion. The rise in commodity prices in world markets has had a negative impact on the outlook for economic growth (in August, gasoline prices in China increased by over 17% year on year). The Chinese authorities are trying to obtain coal, gas, or crude oil from Russia, taking advantage of its situation (a barrel of Urals oil sells for about $30 less than Brent). They authorities are also re-opening closed mines and coal-fired power plants, which may threaten the achievement of the previously assumed emission limits.

In domestic politics, the CCP leadership continues to discipline the party apparatus, mainly in the justice, security, and technology sectors. On 22 September, the former minister of justice was sentenced to life imprisonment for corruption, and the next day, the former deputy minister of state security was sentenced to death for abuses of power (after 2 years’ imprisonment, the punishment will be converted to a life sentence). A few days earlier, several officials connected to him were sentenced to long prison terms for corruption. In August, Xiao Jianhua, a billionaire who purported to be one of the bankers for the Xi family and was kidnapped in 2017 from Hong Kong, was also sentenced to 13 years in prison for corruption and financial crimes. Also, from June to August this year, four managers of the state fund for the development of semiconductors, which since 2014 has worked to reduce China’s dependence on U.S. supplies, were detained on corruption charges.

The relatively early announcement of the date of the congress by the Politburo (as in 2017) suggests that most of the candidates in the elections to the CC, the Politburo, and the SC have already been agreed, most of them as Xi intended. This is confirmed by, among others, the recent promotions of his protégés, including the new minister of public security in June, the deputy head of the central bank in August, and the deputy of the CC’s propaganda department in June.

External Challenges

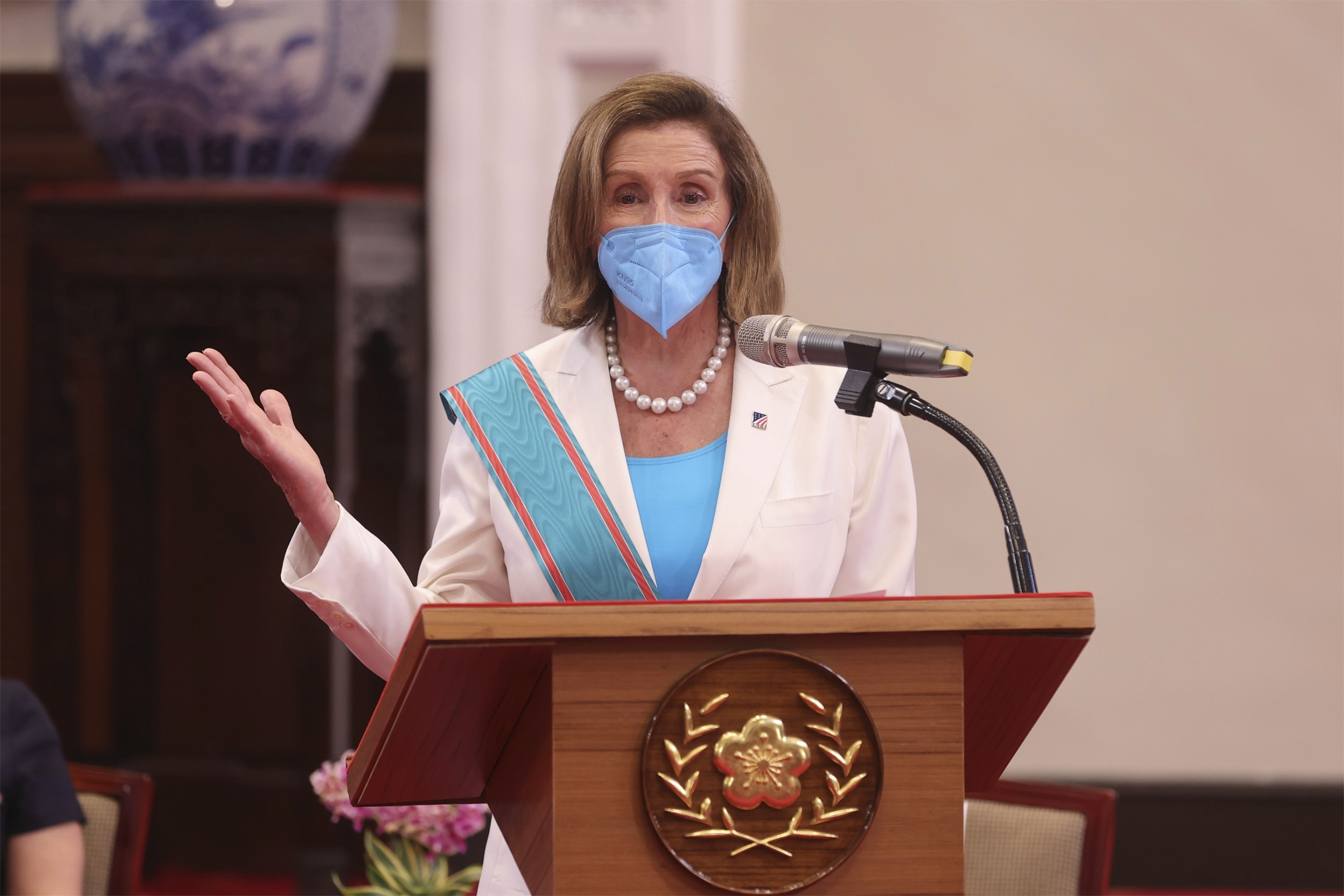

The determinants of China’s foreign policy also became more complicated in the last year. The commencement of negotiations on the Indo-Pacific Economic Framework for Prosperity (IPEF) and the activity of the Quad (Australia, India, Japan, U.S.), the establishment of AUKUS (Australia, the UK, the U.S.), and the intensified political and economic cooperation between the United States and Taiwan confirm the intensification of the rivalry with China. The PRC authorities maintain a confrontational stance towards the U.S., but try not to escalate it too much, in part due to China’s dependence on economic cooperation with the U.S. For example, the Chinese agreed to the possibility of inspections by American institutions of Chinese companies listed in New York, which were threatened with removal from the stock exchange for lack of transparency. An important element of the PRC’s policy towards the U.S. is China’s deepening cooperation with Russia. As was evident during the Xi-Putin meeting in Uzbekistan in September, China is trying to emphasise its dominant position in relations with Russia. However, it still includes mutual political support, not only on Russian revisionist arguments in Europe and Chinese arguments towards Taiwan but also on increasing trade between them, among others. In January-August this year, Russian exports to China increased by 50% on an annual basis, allowing Russia to deflect the negative effects of the sanctions.

China also has failed to record many successes in its policy towards the EU, including distracting it from cooperation with the U.S. The confrontational rhetoric of Chinese diplomacy, sanctions, and disinformation in the context of the coronavirus pandemic even strengthened the EU’s position calling on China to abandon unfair trade practices and observe human rights. Chinese political support for the Russian invasion of Ukraine has also deepened the EU’s cooperation with the U.S., including in the Indo-Pacific, for example, in the context of China’s policy towards Taiwan. The Chinese authorities hope that the difficult economic situation of the EU and energy problems this winter will strengthen the arguments about the need to intensify economic cooperation between EU countries and China. This is to be achieved by minister Wang Yi’s visit to Europe, planned for October, as well as the invitation by Xi to Beijing in November of the leaders of Germany, France, Italy, and Spain. German Chancellor Olaf Scholz and French President Emmanuel Macron were to pre-confirm their visit to China.

Conclusions

For the first time in at least a dozen or so years, the CCP congress will take place in an increasingly difficult situation for China. Both the condition of its economy and China’s international position make it difficult to implement the plans of the party’s leadership, declared, among others, during the congress in 2017. The economic reforms announced at that time have been suspended and the goals in foreign policy (such as the takeover of Taiwan or closer cooperation with the EU) are more difficult to achieve. The measures taken by the leadership of the CCP to deal with both social and economic problems and foreign policy are prudent and of an ad hoc nature. It is difficult to determine the influence of these factors on the future composition of the CCP’s organs. Xi’s greatest concession to his opponents could be that Hu Chunhua, a politician from the circle of the current head of government, Li Keqiang, may join the SC (and become prime minister in March 2023). Before the congress, it was crucial to strengthen the image of power and silence critics of the current leadership, and hence, the intensified anti-corruption campaign and, in foreign policy, anti-Western propaganda and support for Russia's revisionist ambitions. The aggressive actions of China towards Taiwan are also an expression of Xi strengthening his position before the congress.

Xi’s September trip to Kazakhstan and Uzbekistan, the first one outside the PRC in 2 and a half years, and the early announcement of the date of the congress, testify to the party leadership’s sense of confidence in the outcome of the congress. Xi most likely will be re-elected for a third term. The party dynamics and the scale of the problems will bring a continuation of the current policy of centralisation of power and confrontation with the West. In the view of most of the CCP’s leadership, including Xi himself, this is the only way to strengthen China’s international position. Cooperation with Russia, revisionist demands, including those towards Taiwan, and accusing the EU of supporting the island, indicate that the political context in EU-Chinese relations is of greater importance to the CCP leadership than economic cooperation. This may mean tightening the PRC’s policy towards the EU, including, for example, limiting dialogue on climate issues or intensifying disinformation, especially when the EU strengthens its cooperation with the U.S. and further attempts to reduce its economic interdependence with China. In this context, the plans for an autumn visit by EU leaders to the PRC should be reconsidered. Such a visit will strengthen the Chinese authorities’ conviction about the possibility of pulling the EU away from the U.S. and will be used by Xi to strengthen his position at the beginning of the next term of office.