Challenges for China's Economic Development in 2022

Last year and the beginning of this year were successful for the Chinese economy due to a rebound after the slowdown caused by the COVID-19 pandemic. However, changes in the economic model designed to increase self-sufficiency in production and raise consumption face obstacles, including the persistence of the pandemic and problems in the real estate sector. The effects of the war between Russia and Ukraine, including rising commodity prices, may also result in a slower than expected growth rate this year. China's economic plans and cooperation with Russia should encourage the EU to reduce its bilateral economic interdependence with the PRC.

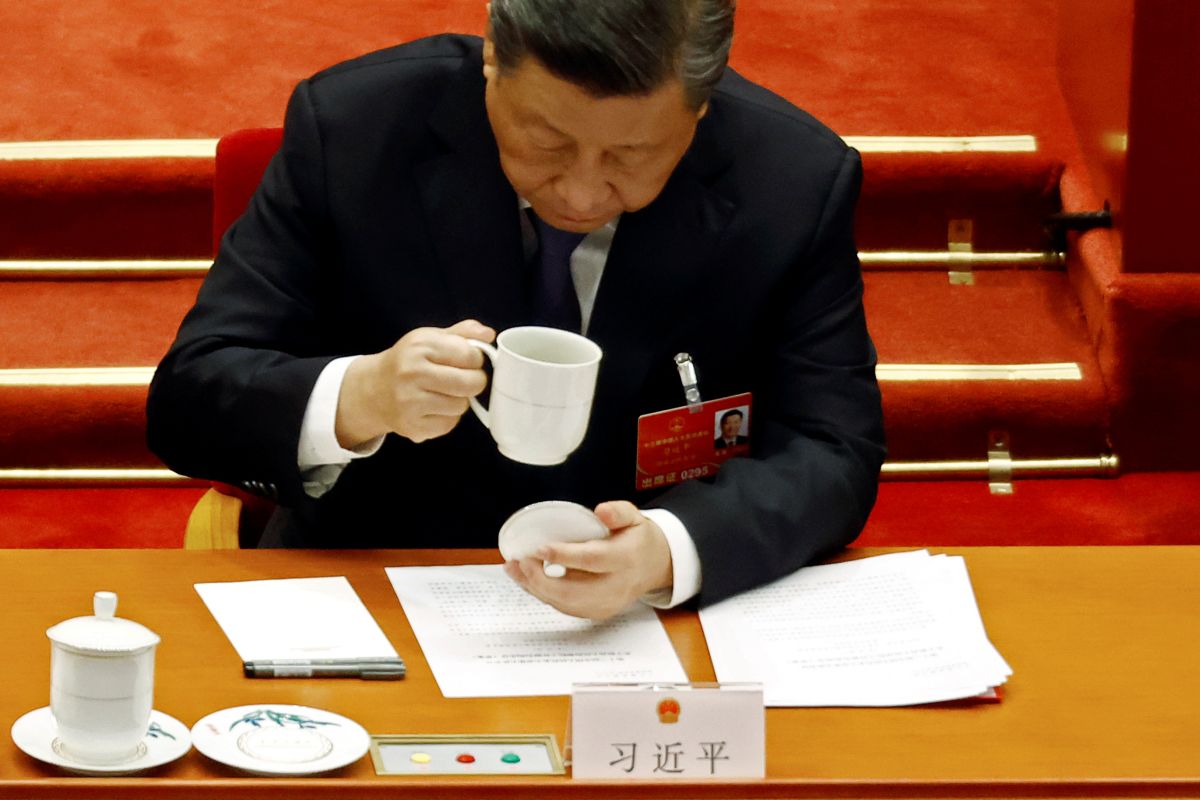

ALY SONG/ Reuters/ FORUM

ALY SONG/ Reuters/ FORUM

Condition of China`s Economy

China's economic growth in 2021 was 8.1% (of the biggest economies only India grew more, with 9%). This resulted from the recovery in the world economy (last year's global GDP growth amounted to 5.9% compared to a decline of 3.1% in 2020), which was favourable for Chinese exports. In 2021, there was a strong increase in, among others, industrial production in China (by 9.6% year on year) and investments in the manufacturing sector (by 13.5%).

There was also high consumption growth, including retail sales, which increased by 12.5% year on year (against a low base from 2020, when its value fell by 3.9%), but it slowed down sharply towards the end of last year (in December, sales increased by only 1.7%). This contributed to the weakening of the GDP growth rate, which amounted to only 4% in Q4. Chinese authorities seek to base the future model of the Chinese economy on consumption and domestic production as part of “double circulation”. According to this, China's development is to be based on its domestic market, and cooperation with foreign countries is to be focused on selected activities such as acquiring technologies. The level of consumption at the end of the year was influenced by, among other things, the "zero-COVID" strategy, assuming frequent local lockdowns, supply problems caused by disruptions in supply chains, and uncertainty in the labour market (officially, unemployment in cities in December last year remained at the level of approx. 5%, but in the whole country it was probably higher). However, the results for China`s economy from the beginning of this year were positive. Between January and February, retail sales increased by 6.7% year on year (with a higher base than the year before), industrial production by 7.5%, and investments by 12.2%. China`s government forecasts economic growth throughout 2022 of around 5.5%, less than in the years before the pandemic.

Internal Problems

In the near future, the challenge for the Chinese economy will be the wave of coronavirus infections. As of April 12, various forms of lockdowns had been introduced in more than 40 cities, including Shanghai. In total, they covered areas inhabited by over 25% of China`s population and accounting for over 40% of its GDP. This limits production and disrupts supply chains, reduces consumption, and contributes to stock market drops. The authorities want to stimulate demand and business activity, for example, through tax breaks (worth around $400 billion, or around 2% of GDP this year) and infrastructure investments. In the last year, problems in the real estate sector were also revealed, with most of the largest companies having difficulties maintaining financial liquidity (including the most indebted firm, Evergrande). The bankruptcy of these companies, often financially linked to Chinese politicians, threatens the stability of the domestic economy. Therefore, in addition to supporting developers and the banking sector, the authorities are trying to limit speculation on the market (over 15% of Chinese people have more than one property) by imposing, among other things, restrictions on taking out loans or planning to introduce a real estate tax (with a pilot being carried out in, for example, Shanghai). Further challenges for the Chinese economy include environmental issues and changes in the energy sector, including the shift away from coal, which may cause interruptions in energy supplies, mainly for industry, as was the case last year.

The International Context

A potential decline in global demand as a result of, among other things, rising inflation, is a threat to Chinese exports. It will be influenced by the effects of the war in Ukraine, which may impact the Chinese economy. First of all, it is associated with an increase in prices on global energy (mainly oil), food (of which China is a large importer), and artificial fertiliser markets. As a result, inflation in China amounted to 1.5% year on year in March, which is 0.6 percentage points more than in February. At the beginning of this, year China lifted restrictions on wheat imports from Russia, which contributed in January and February to an increase in bilateral trade in goods by 40% year on year. Accumulated grain stocks can be used to lower prices on the Chinese market. Although China supports Russia politically, it distances itself from helping it to circumvent the sanctions imposed, by the U.S. and the EU, fearing that it will be subject to secondary restrictions. However, it wants to maintain trade relations with Russia, increasingly using yuan for transactions to buy, for example, Russian coal or oil, which is intended to reduce dependence on settlements in dollars.

Access to foreign markets remains a priority for China. In the EU, the most important in this context are relations with Germany, France, the Netherlands and Italy, as the main recipients of Chinese exports and investments. China is, for example, reducing joint-venture quotas for BMW and has agreed to regionalise the sale of French pork (in view of the presence of ASF). The government is trying to influence these countries to weaken mechanisms designed to protect the EU market, such as the anti-coercion instrument. The EU's economic cooperation with China also gives the latter the possibility of political pressure, an example of which is retaliation against Lithuania, affecting the whole EU single market.

In relations with the United States, sanctions limiting international cooperation of Chinese companies, their technological development and access to key components, such as semiconductors, are of greatest importance for China. China is trying to remedy this by stronger integration with international value chains. This is achieved by, among other things, the Regional Comprehensive Economic Partnership (RCEP), which came into force on 1 January and brings together China and 14 other Indo-Pacific countries. Another challenge for Chinese exports is the law adopted in the U.S. in January (which will come into force in June) prohibiting the import of products manufactured with the use of forced labour. This law is related to the situation of Uighurs in Xinjiang, who were systematically hired from the state as employees by companies from all over China.

Conclusions and Prospects

China`s economy has so far managed to avoid the more serious problems associated with the coronavirus pandemic. However, it highlighted existing challenges, such as corporate indebtedness. Moreover, the lockdown strategy applied by the authorities is a problem especially for the condition of micro and small businesses, which are responsible for around 60% of China's GDP and 80% of employment in cities.

In 2022, internal stabilisation will be of paramount importance due to the autumn congress of the Chinese Communist Party (CCP). For this reason, introducing major changes is unlikely in the coming months. This applies, for example, to the property tax, as it would give the government more precise information on the assets of party members, which could weaken their support for the authorities. The real estate sector shows the problem of business and political ties in the implementation of economic reforms. Therefore, its restructuring will proceed slowly, under the close supervision of the CCP. The possible weakening of the pace of economic growth (the IMF has already lowered its forecasts for China for this year by 0.8% percentage points to 4.8%) will encourage the authorities to further stimulate the economy. This may cause difficulties in greater financing for housing and education policy, which is to strengthen the consumption of the Chinese middle class and contribute to the implementation of “double circulation”. The scope of economic cooperation with Russia will also be a challenge for China. Increasingly higher costs for this country resulting from the sanctions may induce China to informally support it in order to prevent the collapse of the Russian economy, thus maintaining Russia's ability to destabilise the security situation in Europe. This can be done, for example, through Chinese investments, the development of trade in yuan, lending to Russian companies, or access to technology from China. Due to the fear of EU or U.S. restrictions, China will focus on sectors of the Russian economy not subject to sanctions, such as food, agriculture, gas and oil.

The European Union, as the main export destination for Chinese enterprises, has instruments to put pressure on China, for example in terms of reciprocity in market access or China's violation of WTO rules. The problem remains the lack of political unity of the EU Member States, which are, to differing extents, engaged in economic cooperation with China. However, China's support for Russian aggression against Ukraine may contribute to a more coherent EU position towards China. The context of Sino-Russian cooperation may contribute to the perception of China by the EU as a systemic rival rather than an economic partner and lead it to reduce bilateral economic interdependence by, for example, by diversifying supply chains.