The UK's First Comprehensive Space Strategy

The development of a comprehensive space strategy that encompasses civil and military aspects is in line with the British global strategy adopted last year. Its main goal is to strengthen the domestic space sector in the face of increasing competition on world markets and to make the United Kingdom one of the leaders in this field. The implementation of the strategy will be supported by increased funding, but without setting investment priorities and establishing closer cooperation with allies, including European countries, it will be difficult to achieve the objectives.

Skyrora/ Cover Images/ FORUM

Skyrora/ Cover Images/ FORUM

Work on the UK’s space strategy had been ongoing for several years and results from the growing importance of satellite-based services for the economy and the progressive militarisation of space. The sector has witnessed increasing competition, not only between global leaders such as the U.S., Russia, and China, but also countries with less potential (e.g., Australia, Poland) and private enterprises.

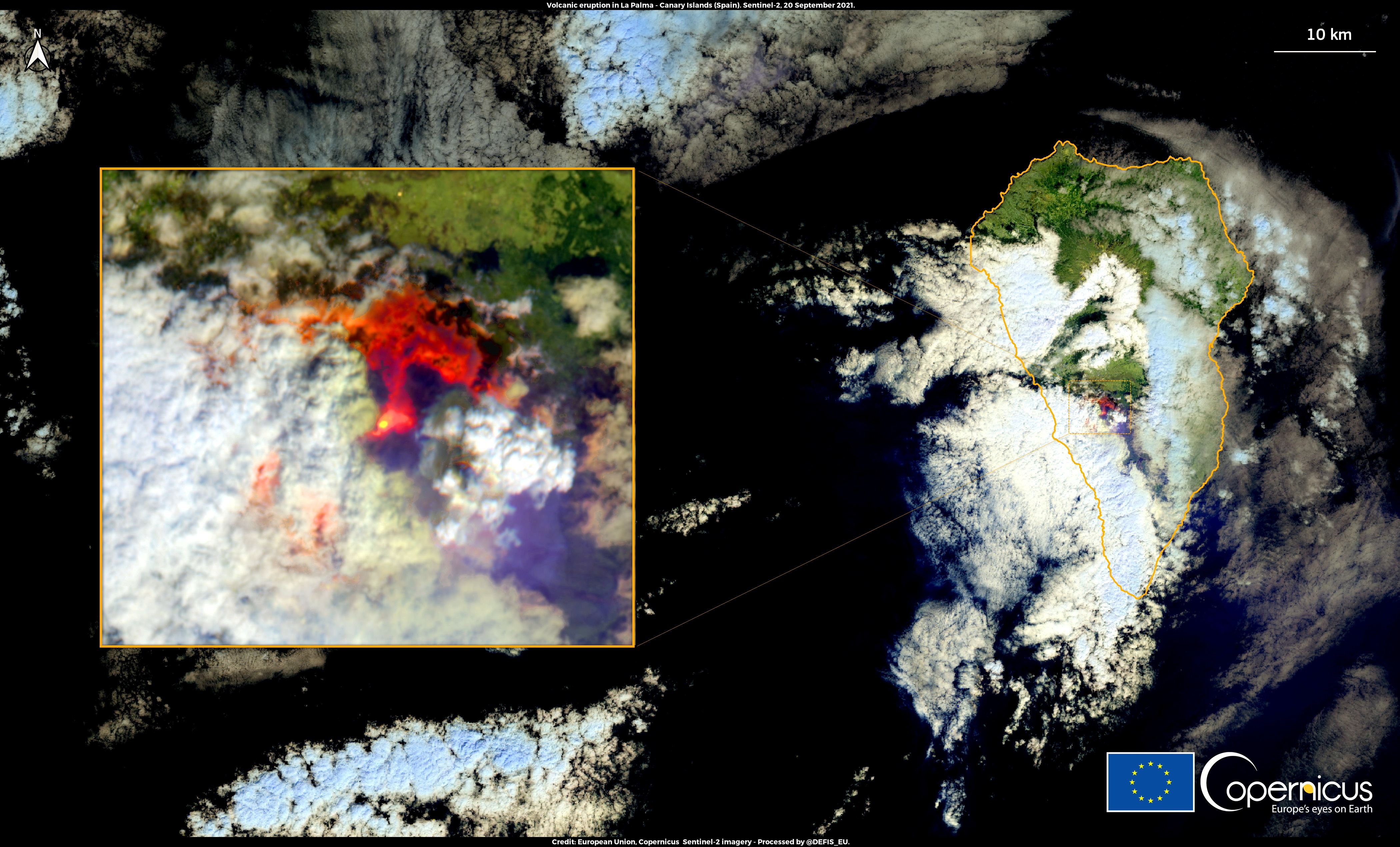

The stimulus to intensify work on the strategy was Brexit, which resulted in the UK leaving the EU Space Programme and participation in its technologically advanced global systems for navigation and Earth observation, as well as space surveillance and tracking. Initially, it was assumed that the UK’s participation in the EU Copernicus observation system would be maintained, as it is implemented with the help of the European Space Agency (ESA), and both the EU and the UK remain members. So far, however, no agreement has been reached on this matter, and the largest ESA contracts for increasing the functionality of the Copernicus system from 2020 have been awarded to companies from outside the UK (German, Italian, French, and Spanish).

Finally, in September 2021 the UK’s National Space Strategy was published, setting out the main policy directions. Additionally, in February 2022 the Defence Space Strategy was presented, clarifying the role of space systems in the British defence sector. They provide details on the assumptions of the British global strategy presented in March 2021.

Goals

The National Space Strategy identifies 10 priority areas related to economic growth and competitiveness, global technological and scientific potential, and international cooperation, as well as the development of autonomous civil and military capabilities in the space sector. The development of the domestic space industry and its impact on the country’s economic growth are of greatest importance. The strategy also presents ambitious plans for the UK to participate in establishing global rules for the use of space and to place British scientific achievements and space technologies at the world’s top.

The Defence Space Strategy identifies the main challenges related to the militarisation of space and defines the UK’s defence potential in this area. The priority is the development of satellite communications of strategic importance (Skynet), as well as intelligence, surveillance, and reconnaissance (ISR) and space awareness (SDA) capabilities, which are to strengthen the ability to defend against attacks and guarantee autonomy in military operations. The “own-collaborate-access” framework will be applied to achieve the goals set, thus confirming that the UK will not develop these capabilities on its own.

Potential and Limitations

The growing importance of the space sector, including incentives to create public-private partnerships, will positively affect the UK’s economic and technological development. There is high potential in the plans to launch small satellites into orbit (the first launch is to take place this summer from the Newquay airport in southwest England), as well as the construction of several spaceports in the UK, which would be among the first investments of this type in Europe (along with Norway and Sweden). By the end of 2022 there are plans to open two ports in the north of Scotland—in Sutherland and in the Shetlands. However, their opening is likely to be delayed until 2023 due to legal procedures regarding assessments of launch safety and environmental impact.

The current technological underdevelopment caused mainly by low financing will be difficult to make up for in the coming years. Therefore, the UK is actively looking for new bilateral agreements to support it in achieving its strategic goals. For example, in 2021 the British concluded an agreement with Australia covering scientific, investment, and commercial issues in the space sector, and the UK Space Agency (UKSA) has partnered with the Japan Aerospace Exploration Agency (JAXA), giving new impetus to activities in the areas of science and industry.

The British also maintain their willingness to cooperate with other states within the Five Eyes alliance (UK, Australia, Canada, New Zealand, the U.S.) and NATO. The UK, like the Alliance, recognises space as an area of operational activities and considers the possibility of activating Art. 5 guarantees in the event of an attack on the space infrastructure of member states. The British are investing in expanding their space capabilities, planning to spend in the next 10 years £5 billion on Skynet and £1.4 billion on other capabilities, including £970 million for ISR, £85 million for SDA and £135 million for a Space Command (including training for qualified staff). Despite this, financing at the level of $1.46 billion in 2021 ranks the UK among the countries with medium potential. The spending by the world’s leaders in 2021 was much higher—the U.S. spent $54.58 billion, China $10.28 billion, Japan $4.21 billion, and Russia $3.56 billion. The only country with a lower level of space sector financing, and one with which the UK will tighten cooperation, is Australia ($324 million). Also compared to European spending, the UK budget is relatively low. In 2021, the EU spent $2.57 billion on space purposes, and only the three largest countries—France, Germany and Italy—$3.95 billion, $2.37 billion, and $1.48 billion, respectively.

The impasse in relations with the EU will be an obstacle in the development of the British space potential. Although, in line with the global strategy, the UK shifts its interest to other areas, including Asia and Pacific, both the European space market and the EU’s advanced satellite-based systems will be difficult to replace. Although some initiatives can be developed in cooperation with the EU and European countries within the ESA or on the basis of bilateral agreements, there has been no breakthrough in this regard so far. For example, the British strategy does not refer to potential joint European projects and is limited to one security initiative, a Combined Space Operations Centre (CSpOC), which is formed by France and Germany with the Five Eyes countries. The British clearly indicate countries such as Russia and China as sources of threats, which in the future may provide an impulse for action with the U.S. and European countries to strengthen the security of space infrastructure and systems.

Conclusions and Perspectives

The strategic vision of building the British space potential covers the 2030 period. Despite indicating several phases of its development, there is no detailed schedule or list of specific goals. This can hamper investment efficiency (both on the government and corporate sides) and also will make overall assessment of policy implementation more difficult.

Increased investments in the domestic space sector will strengthen the UK’s autonomy. The plans to launch satellites into orbit and construct several spaceports are primarily prospective. Polish companies can apply for contracts as subcontractors as they have experience in this field. Crucial for Poland are also UK activities in the field of space security (including Skynet), which strengthen NATO’s defence potential. It is important as the information obtained from the EU systems is classified and cannot be directly shared within the Alliance.

In the coming years, the planned financial outlays and new international partnerships will not allow the UK to compete on its own in the global market. Building autonomous capabilities on a large scale, for example, in the field of navigation and observation, will not be possible due to the level of technological advancement and high costs. Even the largest European countries do not undertake such projects on their own, rather building the world-class Galileo and Copernicus systems within the EU. The prolonged deadlock in relations with the EU (e.g., on the Copernicus system) may lead to a further cutting off of British companies from European tenders, which will adversely affect their technological potential and financial profits.