EU Agriculture Manoeuvres between the Wartime Emergency and the Green Transition

Growing input costs constitute a serious problem for EU farmers. Although this year higher prices for agricultural products and state aid protected them against a drastic loss of income, in the long term, high prices of fertilisers, fuel, and energy related in part to the war in Ukraine threaten profitability and complicate planning. In the meantime, this summer’s drought demonstrated how destructive climate change is for agriculture. Faced with multiple challenges, Member States are prioritising financial support for farmers and maintaining the level of production in the EU. In the name of these objectives, they are ready to delay implementation of the green transition in agriculture.

Agencja Wschod / Forum

Agencja Wschod / Forum

Situation on the Market

Energy prices increased in the EU as economic activity picked up following the strictest lockdowns in 2020. The Russian aggression against Ukraine contributed to this trend. Although prices have started to fall (oil since June, gas since August), they remain higher than in the first semester of 2021, gas in particular. The situation on energy markets impacted the prices of agricultural inputs. In spring and summer, fuel and electricity in the EU were 30-50% more expensive (year on year). The market for fertilisers was also disrupted. As prices of natural gas—a basic raw material in manufacturing of nitrogenous fertilisers—increased, some companies halted or reduced production. In autumn 2021, the average price of this type of fertiliser was about 100% higher than in spring, while in April 2022 it tripled. The price of potassium fertilisers, most of which were imported to the EU from Belarus and Russia, went up by 150% after the invasion.

Data regarding prices of agricultural products suggests that for the majority of farmers, higher revenue compensated for more expensive inputs. In July, prices of cereals were 30-70% higher (year on year), milk went up by 44%, and poultry by 30%. In Poland, the average price of a basket of products, including cereals, milk, and meat, rose by 58%. However, another year of expensive inputs will entail a greater threat to profitability. For farmers who used their stocks of fertilisers bought earlier on better conditions, their current prices will be more of a problem, as will potential new, more expensive tariffs on electricity. If farmers decide to buy less fertilisers, they could also consider limiting the planted area.

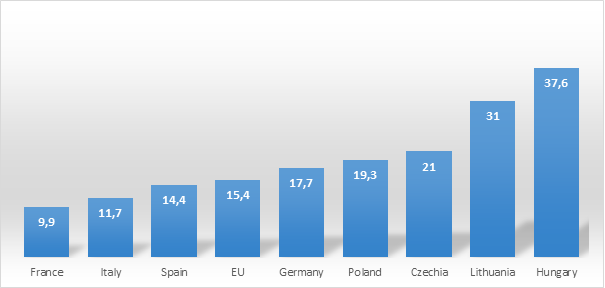

More expensive fuel and energy have also affected other participants in the agri-food value chain, such as transportation and processing, and eventually consumers. Food inflation is particularly high in the Baltic States and Central Europe (see Figure 1).

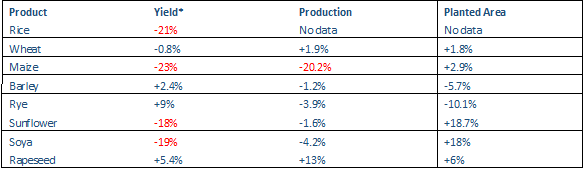

In the summer, a large part of the EU was affected by drought, which reduced yields and harvests. On 22 August, the Joint Research Centre (part of the European Commission) reported that 47% of Europe’s territory was in a warning condition (the second of the three-level system depicting agricultural drought—soil moisture in deficit) and 17% in alert conditions (the highest level, indicating vegetation shows signs of stress). Rice, maize, olives, sunflower, and soya were particularly affected (see Table 1). The EU production of sunflower and soya decreased despite considerable growth of the planted area (almost by a fifth).

Another challenge for the EU was the blockade of Ukrainian agricultural exports caused by the Russian aggression. Ukraine is a major producer of cereals and oilseeds and therefore, the prospect of its crops being cut off from world markets provoked a spike in prices (wheat by a third, maize by 20% in comparison to pre-invasion prices). Consequently, there were widespread concerns about the availability and affordability of food in developing countries, in Africa and the Middle East in particular, which depend on imports of cereals to feed their populations and ensure their political stability.

EU Actions

A few weeks after Russia’s full-scale invasion of Ukraine, the EU mobilised financial support for Member State farmers and softened environmental requirements in the hope of boosting production. In July, the EU Council, on a proposal from the Commission, decided—despite criticism from environmental NGOs—that also next year farmers will be able to sow land that would otherwise be left fallow to improve the condition of the soil and protect biodiversity. Although the EC claims that climate change remains the major threat to agriculture and confirms plans related to the green transition, spelled out in the Farm to Fork strategy published in 2020, its proposals meet with growing opposition. A draft regulation that obliges Member States to reduce the amount of chemical pesticides by 2030 by 50% at the EU level provoked strong criticism from the Member States. Its opponents argue that the EC has not assessed the impact that the reduction could have on yields. The largest farmers’ associations claim that in a period of political and economic instability the EC should abstain from proposing new objectives related to environment and climate as they would be too much of a burden for farmers. Instead of a far-reaching transformation, they suggest adjustments to the model of intensive farming. These could include planting more resilient varieties, using fertilisers and pesticides more effectively thanks to advanced digital technologies, and reducing dependencies through boosting renewable energy generation and own fertiliser production, and diversifying the supply of energy.

Agricultural Trade in the Shadow of the War

The EU launched an initiative dubbed “solidarity lanes” to assist Ukraine in exporting its products. A digital platform was created to facilitate contacts between importers and Ukrainian producers, while crops are transported via the Danube to ports in Romania or by land routes, chiefly through Poland. From May to October, 12.5 million tonnes of goods entered this way into the EU. In the first half of the year, their value reached €4.4 billion, which constituted a 60% increase in comparison to the same period last year.

However, the capacity of new routes is limited by logistical issues. For Ukraine, unblocking Black Sea ports, a key gateway for agricultural exports before the invasion, is of critical importance. Thanks to an agreement between Ukraine, Russia, and Turkey, from August to October, 9.5 million tonnes of agricultural products were exported. However, Russia’s criticism of the deal makes its future uncertain. This is reflected in prices, which, although lower than at their peak in April and May, remain above the pre-invasion levels. Recipients of Ukrainian cereals (e.g., Egypt, Morocco, Pakistan, Albania, and Nigeria) turned to Europe in search of new sources of supply, especially in the first months of the war. The volume of wheat exported from the EU between March and August grew by 25% compared to the same period last year. In the first half of the year, the value of exported cereals jumped by 46%.

Outlook

As the war continues, a lasting decrease in energy prices is unlikely. Meanwhile, uncertainty around the export of Ukrainian crops will complicate stabilisation of international grain markets. These circumstances are conducive to continued tensions within the EU around reconciling short- and long-term goals: maintaining production and supporting farmers’ incomes on the one hand, and mitigating the impact of farming on the environment, on the other. Despite warnings by the scientific community of more frequent extreme weather events, a majority of EU members is ready to delay actions aimed at protecting biodiversity and reducing greenhouse gas emissions generated by agriculture.

However, in some areas the current crisis could favour the green transition in farming and, more generally, in the food system. High prices of fertilisers encourage stakeholders to pay more attention to the condition of soils and techniques for optimising fertilisation. Consumers, in the meantime, will have a stronger incentive to reduce food waste. A study carried out in the EU in 2020 revealed that households wasted 70 kg of food per person, more than all other sectors (primary production, processing, and restaurants) combined. As energy-intensive products, such as meat and greenhouse-grown vegetables, become more expensive, consumers could look for alternatives in local, seasonal products. Apart from financial assistance to farmers, better targeted actions are needed in the framework of national strategies for implementation of the Common Agricultural Policy. These could include improved access to consulting on more effective use of fertilisers and organic alternatives, and increased financial rewards for environment-friendly practices.

Figure 1. Food Inflation in Selected EU Member States (September 2022)

Source: Trading Economics.

Table 1. Changes in Yields and Production of Selected Cereals and Oilseeds in the EU (2022)

* Change in relation to the 5-year average

Source: European Commission, Directorate General for Agriculture.

.jpg)