Development of Small Modular Reactors in the EU on the Horizon

There is growing political support in the European Union for developing small modular reactor (SMR) technology as part of the concept of building a new nuclear architecture. SMRs can potentially become an important element of the EU’s technological sovereignty, combining low-carbon reindustrialisation with an efficient energy transition in the long to medium term. The opportunity to develop SMRs in the Union will require aligning regulation, increasing funding at the EU level, and improving the competitiveness of EU projects vis-à-vis the U.S. The anticipated launch of the first SMR is expected to occur in the late 2020s or early 2030s.

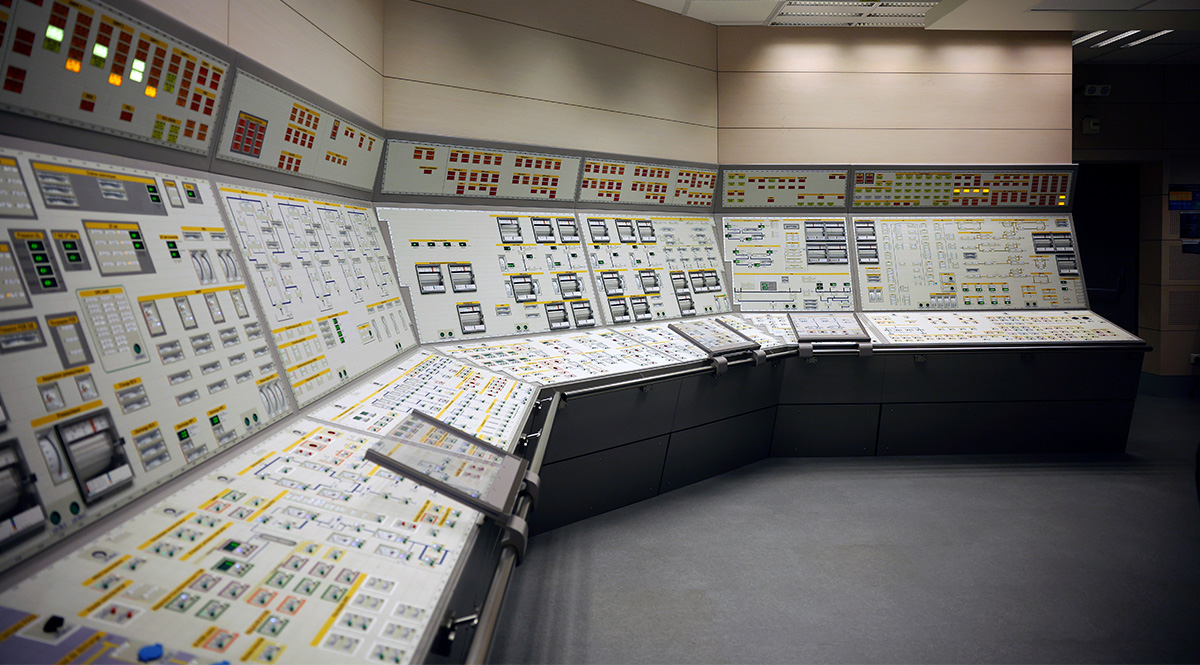

SARAH MEYSSONNIER / Reuters / Forum

SARAH MEYSSONNIER / Reuters / Forum

SMR technology is small (producing 5-300 MW, while most modern nuclear reactors have a capacity of about 1,000 MW) and comparatively faster and cheaper to build than regular units to produce electricity and heat. They are being adapted to replace conventional power and CHP plants, supporting industry and energy systems using a growing share of RES. The long-standing marginalisation of nuclear power at the EU level as a technology that can support the energy transition and the active opposition to it by some countries have limited the development of SMR technology in the Union. Most of the European Commission’s (EC) activities supporting SMR in the last decade have focused on research funding and human resources training. The lack of funding and development strategies to date is now being reviewed.

An Opportunity for SMR in the EU

A change in approach was brought about by, among other things, the energy crisis related to Russia’s full-scale invasion of Ukraine and the sanctions imposed on the Russian energy sector. It prompted reluctant nuclear states (including Germany, Luxembourg, and Austria) to acquiesce to the inclusion of SMR in EU development strategies. Further support from the EU level, including direct funding of investments from EU funds and the re-evaluation of this technology in climate plans, in line with COP28, is being sought by the countries of the EU Nuclear Alliance, established at the beginning of 2023, which includes Bulgaria, Croatia, Czechia, Finland, France, the Netherlands, Poland, Romania, Slovakia, Slovenia, and Sweden (Belgium, Estonia, Italy, and others are also planning to develop SMRs).

In recent months, the EC has been successively adopting some of the demands of SMR proponents. This technology can support the energy and industrial transformation and the building of EU technological sovereignty. It is expected to stabilise supply and prices during periods of declining energy production from RES while at the same time serving to reduce emissions and diversify the energy mix. Due to its vast industrial applicability, it is expected to contribute to the low-carbon reindustrialisation of Europe. In June 2023, the EC established the pre-Partnership, a format for cooperation between industry, research organisations and regulators, which will become an SMR industrial alliance in 2024. It will aim to create investment opportunities, an enabling regulatory environment, and support technology cooperation within the EU. The Commission envisages the implementation of SMR in the Union over the next 10 years, which requires the development of a long-term and stable policy for the development of the sector.

The EC consultations include the public authorities, industry representatives, research institutions on R&D, and regulatory and financial issues. It envisages intensifying EU support for European projects and innovations in SMR technology (particularly sought by France, Belgium and the Scandinavian countries) and continuing to fund training personnel capable of serving the sector. Concerning regulation, it is developing solutions to ensure the security and harmonisation of project certification in line with the Euratom Treaty. These include support for regulatory alliances (such as the French-Czech-Finnish pilot project for the most advanced French SMR reactor project, NUWARD). The industry also calls for an audit of existing regulations to simplify them and adapt them to the new technology. In addition, the EC consultation is expected to include security of the supply chain and rules for the disposal of spent fuel. Particularly important, as pointed out by the European Parliament in its December resolution, remains the provision of adequate funding for the development of SMR (including obtaining credits from the European Investment Bank or EU funds related to the Just Transition Fund or the so-called EU Projects of Common Interest, IPCEI).

Development of SMR Technology and Opportunities for Import

There are currently several SMR projects in the EU, most of which are of a research nature. The most important one is NUWARD, designed by the state-owned French company EDF and foreign entities. It has received financial support from the government, and in July 2023 the company began the certification process necessary to move to the commercialisation phase. Construction is anticipated before 2030. Furthermore, EDF is developing an international deployment strategy (preliminary talks are underway with investors from Czechia, Finland, Poland, Sweden, and Italy). In addition, innovative but not quickly commercially viable projects are underway in Belgium (a lead-cooled SMR), Denmark (in cooperation with partners from South Korea), Sweden or Finland (the first district heating plant using SMR technology). Their commercialisation will depend on the possibility of obtaining financing for serial investments and the course of certification, determined by each country’s adopted SMR development policy. At this point, it is difficult to envisage the completion of commercial investments in the EU before 2033, without additional financial and regulatory commitment from Member States. Therefore, most stakeholders assume initial investments using U.S. technologies as the most developed.

In the U.S., advanced development work is being carried out with regulatory and financial support from the authorities, who want to ensure that the U.S. is the global leader in SMR development. Dominance is to be ensured for U.S. companies, particularly by institutional support in exporting SMRs to European markets (such as the Phoenix programme with a budget of $8 billion, to serve Central European countries). One project in which Polish KGHM is interested is the VOYGR design developed by NuScale (the first one to be certified by the U.S. regulator). It was scheduled to be completed in the U.S. in 2029 but was cancelled in 2023. The reason was the rising costs of the investment to the energy produced—an increase of 50% over assumptions exceeded the average costs of solar and wind (despite subsidies granted under the U.S. Inflation Reduction Act). The company announced the continuation of the project in another location, but commercial deployment before 2030 is doubtful. According to the U.S. Nuclear Regulatory Commission, certification is also underway for the projects BWRX-300 (owned by GE-Hitachi) and SMR-160 (a Holtec company). The former, in particular, is expected to be ready for commercial deployment at the end of 2028, and the Polish Orlen Synthos Green Energy is involved in it in close investment cooperation.

China and Russia are competing for a leadership position with the U.S., although the EU does not foresee the possibility of importing technology from those countries for security reasons. Canada, South Korea, Japan, and the United Kingdom are also well-advanced. However, despite optimistic announcements, most of the projects are struggling with underestimated costs and protracted investment times. As a result, it can be anticipated that the commissioning of the first SMRs will come only in the late 2020s and early 2030s.

Conclusions and Recommendations

Behind the accelerating development of SMRs is the growing demand from countries and companies needing this technology for a rapid, low-carbon transformation of energy and industry. Additional impetus is provided by EU-level regulatory changes and the COP28 findings qualifying nuclear energy as zero-carbon. For the effective development of SMR in the EU, it is advisable to develop a programme that is holistic (i.e., stimulating the sphere of supply and demand) for the implementation of modern nuclear technologies, to which the work on the Industrial Alliance for SMR and the ongoing activities of the Commission are a step. The opportunity for the development of a domestic SMR industry lies in regulatory alignment, increased funding, and improved competitiveness (in time and cost) against U.S. projects. It will be essential for the initiative’s success to maintain the tacit acceptance of EU members reluctant to use nuclear power. Ensuring adequate safety of the technologies to be implemented will be crucial in the negotiations.

Given Poland’s plans to invest in SMRs, steps including technological diversification, regulatory cooperation, and the adoption of a national strategy for SMR deployment are justified. To achieve these, collaboration within the framework of a nuclear alliance may be valuable, especially with regional countries interested in the development of SMR (e.g., Czechia and Romania). This could help in the development of an EU strategy for SMRs and attract U.S. investment.

.png)