The Russian Economy and COVID-19

Pre-Pandemic Economy

Russia was relatively well-prepared for the economic crisis spurred by the COVID-19 pandemic. At the time of the outbreak, the Central Bank of Russia (CBR) had some of the world’s largest foreign-exchange reserves (a record $570 million). The Russian authorities also had about $160 billion accumulated in the National Welfare Fund (NWF). This money came from surpluses from oil sales when the price of oil exceeded the threshold set in the budget (it is currently around $42.50 per barrel of the “Urals oil” type). Thus, in a crisis, the Russian government was able to finance increased expenses without having to apply for support from international financial institutions. This was facilitated by one of the world's lowest foreign debts (28% of GDP), which was the result of the restrictive fiscal policy pursued by the Russian government in recent years.

This was accompanied by a relatively good situation in the Russian labour market. Thanks to the high level of employment in public sector and state-owned companies (40-50% of all jobs), the domestic unemployment rate in 2010-2019 was below 6% on average. This, combined with regular social benefits (amounting to around 5% of GDP compared to the EU average of around 19%), ensured that Russians had a steady income that was equal to the world average (almost $11,500 per person annually according to the World Bank). Compared to EU countries, the economic situation of Russians is weaker, and made worse by the retaliatory sanctions by Russia on the EU. However, the Russian government is successfully implementing a policy of guaranteeing economic stability, especially in relation to the poorest social strata.

Impact of COVID-19

The first effects of the pandemic were felt by the Russian economy even before the virus appeared in the country. The restrictions introduced in other parts of the world have resulted in a sharp drop in global demand for oil (in April, total consumption of oil decreased by 30% year on year to its lowest level in 25 years). At the same time, the absence of an OPEC+ agreement in March meant that production was not reduced. The resulting oversupply led to a temporary drop in Urals oil prices below $20 per barrel—half the price established in Russia’s budget for this year (the price returned to $40 in June). For the Russian economy, which is dependent on the export of mineral resources (in 2019, these accounted for 65% of exports and 40% of budget revenues), this has meant significant financial losses—in April alone, Russian exports fell by 35% year on year.

The lower demand for mineral resources and the accompanying decrease in global prices of industrial products are reflected in the condition of the national economy. In April and May, extraction of industrial minerals fell (by 37% year on year), production of machinery (by 28%) and light industrial goods (by 17%). Economic restrictions implemented in connection with the COVID-19 pandemic also hit the service sector, which normally accounts for about 26% of Russian GDP. Retail trade dropped by over 21% year on year in April-May. As a result, according to CBR data, Russia’s GDP fell by almost 10% year on year in Q2/2020, more than previously expected by the CBR (8%). The CBR estimates that the economy will start to grow again in Q3 due to the growth of consumption after some of the restrictions are lifted.

So far, however, the crisis has not contributed to a radical rise in unemployment—it was 6.2% in June, just 1.6 percentage points higher than in February. However, in the coming months, unemployment is likely to increase as the notice periods for termination of employment contracts, which employers handed out at the beginning of the pandemic, will come due.

Anti-Crisis Package

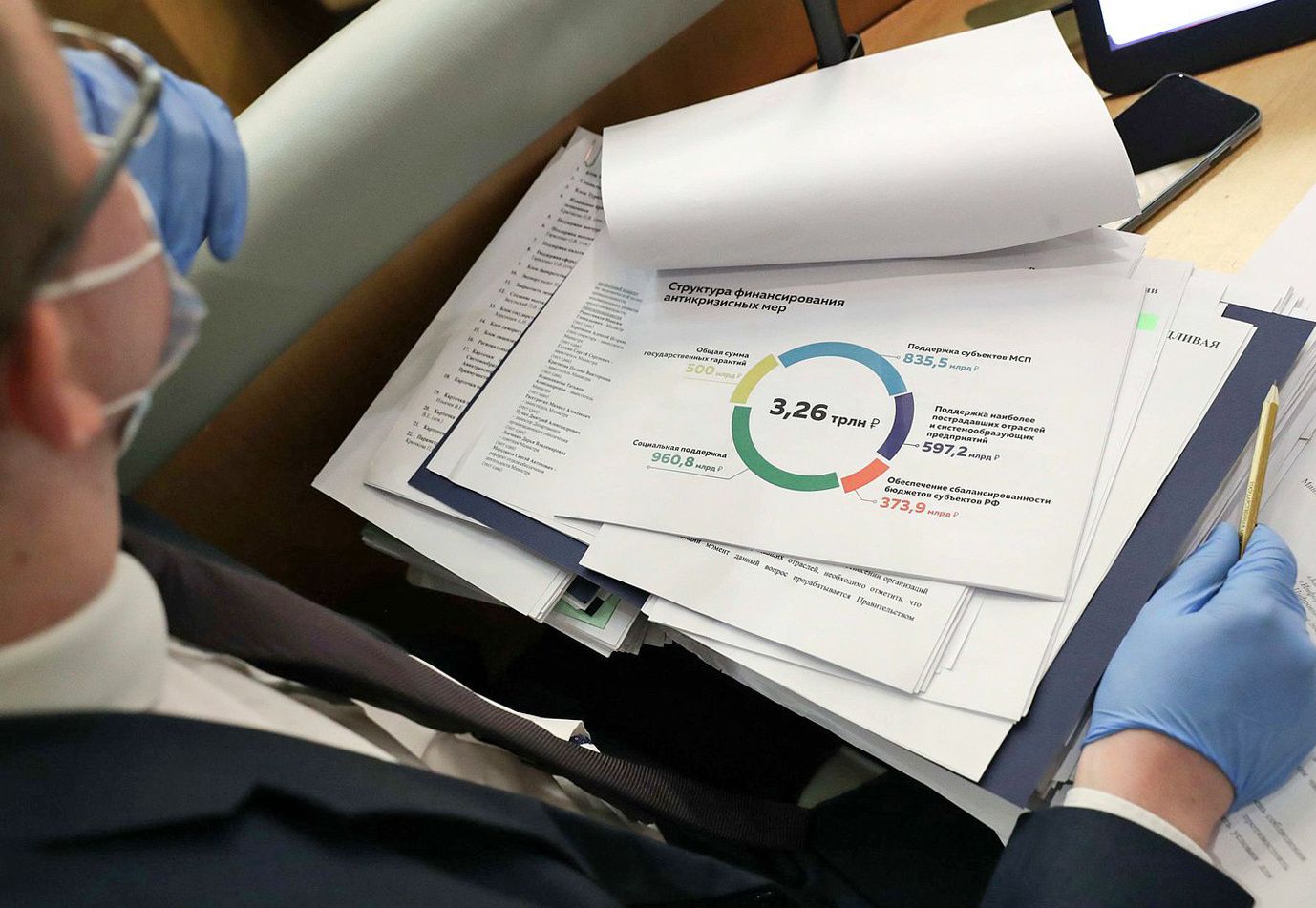

The Russian anti-crisis package amounts to RUB 3 trillion ($43 billion, or about 2.5% of GDP), which is small relative to other countries (e.g., China will allocate 7% of GDP, Germany, 10%, and the U.S., 15%). The main objective of the Russian package is to protect jobs by supporting companies. Of the total, 63% ($27 billion) will go to employers, mainly small and medium-sized enterprises (SMEs) while 16% ($7 billion) will go to the unemployed and parents with children. Only 5% ($2.2 billion) will be used to cover the budget deficits of federation entities. Another 16% ($6.8 billion) are non-cash benefits, mainly tax deferrals or cancellations of certain payments, such as rents and taxes.

Although the Russian support is focused on SMEs, the criteria for granting aid will result in less than half the companies eligible to receive it. Only those sectors considered by the authorities to be most affected by the crisis (e.g., tourism and the hotel industry) are entitled to receive it. Moreover, compensation to companies for maintaining jobs is only $160 per worker (equivalent to the monthly minimum wage, which is also the poverty threshold in Russia), with the national average four times higher. This has caused some companies, especially in large cities, to forego government support, preferring to reduce employment or wages—in May, Sberbank research found that one in two working Russians declared a decrease in wages. In a survey conducted by the Institute of Economic Forecasting of the Russian Academy of Sciences in June, only 9% of SMEs declared that they had benefited from state support, and as much as 51% described the government support as so insignificant that they do not intend to apply for it. The aid addressed to SMEs was also launched late (only on 11 May), which did not allow them to react in time to the first negative effects of the crisis.

Russians are also sceptical about the situation in the country. From March to June, the percentage of people indicating that “things in Russia are going in a positive direction” dropped from 53% to 43%. Nevertheless, Russians positively assess the actions taken by the central and regional authorities in the fight against the pandemic and its effects (66% and 63% positive opinions, respectively).

Conclusions and Prospects

International Monetary Fund forecasts predict a deep recession for the Russian economy of almost 7% in 2020. Although this would be a greater decline than during the 1998 financial crisis when the economy contracted by more than 5%, Russia will not need foreign financial assistance to stabilise the situation. Its improved macroeconomic situation, especially the high level of foreign-exchange reserves, means the Russian government can afford to increase spending, for example, by extending the anti-crisis package, without the threat of losing liquidity or having to increase foreign debt significantly. Assuming the absence of a second wave of COVID-19 in the autumn, the Russian economy, according to the IMF estimates, should record growth of 4% next year. If that happens, Russia will not be forced to make political concessions (e.g., withdrawal from the annexation of Crimea, withdrawal of forces from eastern Ukraine) in exchange for lifting the financial sanctions introduced by the EU and the U.S. Nor will it refrain from its aggressive foreign policy in Eastern Europe and the Mediterranean Basin, where the main instrument of its influence is military force. The Russian authorities do not intend to give up consolidating their influence in either region, which is proved, among other things, by the lack of a decision to reduce budget funds allocated for defence and security in 2020-2022 despite this year’s economic crisis.

Given its high level of financial reserves, the Russian authorities also are unlikely to undertake reforms that would promote increased innovation of the Russian economy, among other things. In the coming years, the economy will continue to be determined by world market prices for the most important Russian export goods, mainly mineral resources, but also arms, chemicals, and agricultural products. However, as a consequence of the crisis, a number of investments will likely be postponed, especially so-called national projects (e.g., doubling non-raw material exports, increasing the number of SMEs by a quarter, digitising the economy—altogether worth about $350 billion), which were planned to be implemented by 2024.

In the short term, due to the COVID-19 pandemic, there will be a significant increase in unemployment (up to 10%) and a decrease in Russians’ real income (by about 6%), which may result in the intensification of economy-related protests. However, it is doubtful that these will turn into more political protests capable of undermining the stability of the regime.