New Opportunities for the European Chip Industry

Europe’s dependence on semiconductor imports, mainly from Asia, is increasing. The European Commission plans to commit billions of euros to attract investment in the sector with the aim of doubling the EU’s share of the global semiconductor market to 20% by 2030. The most advanced project is Intel plants likely to be located in Germany, France, and Italy. This will help secure supplies for the EU economy and may make it easier to attract further investors.

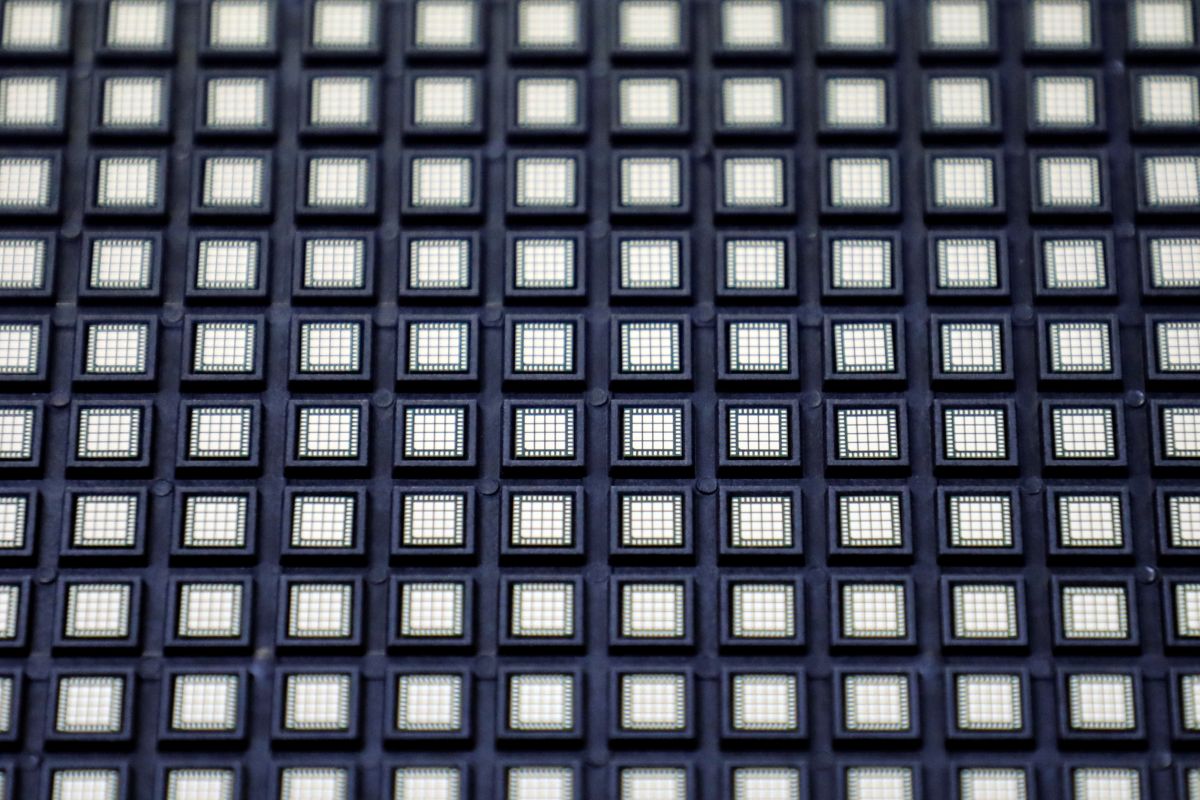

Fot. Reuters/ LIM HUEY TENG/ FORUM

Fot. Reuters/ LIM HUEY TENG/ FORUM

European Chip Sector

As recently as the 1990s, Europe accounted for around 40% of global semiconductor production. This was mainly thanks to the European champions of the mobile phone market: Ericsson, Nokia, and Siemens. A decade later, this share was only about 25%, and in the case of the most advanced chips, it fell from about 20% to zero. As a result of increasing competition from foreign manufacturers and the relocation of production to Asian countries with lower labour costs, Europe’s share of the market has decreased to around 10%. The largest local manufacturers, NXP Semiconductors (Netherlands), Infineon (Germany), and STMicroelectronics (Switzerland), produce less technologically advanced chips, mainly for the automotive sector, power electronics, electromechanics, and the wider industry. Within this niche, they remain global leaders. However, they are limited by their production capacity, hence part of their production has to be outsourced, mainly to Taiwan. In addition, they are vulnerable to takeovers by competitors, such as Samsung, which recently explored the possibility. More advanced chips, although still of previous generations, are produced in Ireland in the Intel factory there. New-generation chips, which are a key resource for modern, highly developed economies facing climate, Industry 4.0, or e-mobility challenges, are imported from Taiwan and South Korea. Europe’s strongest asset remains the production of the latest generation of lithographic equipment (which applies an integrated circuit pattern to silicon wafers), of which the Dutch ASML is the only global producer.

The European Commission’s Plans

Reversing the negative trend is one of the key objectives of the European Commission (EC) for the next decade. The priority focus stems from the global chip shortage and disruption to supply chains as a consequence of the COVID-19 pandemic. Under the Digital Compass, a €150 billion programme announced in March 2021, the EC is targeting a doubling of EU semiconductor consumption and an increase in market share to 20%, with global demand expected to grow exponentially. In addition, as indicated by the commissioner for the Internal Market, Thierry Breton, by the end of this decade Europe should be producing the most advanced semiconductors, even in 2 nanometre (nm) technology (the size of the transistors used—the smaller, the greater the energy efficiency and computing capacity of the chip). Actions in this area will be coordinated within the framework of the European Chips Act, a draft of which will be presented in the second quarter of this year, and the IPCEI mechanism (the EU’s international industrial strategic projects, for which public aid of Member States is allowed). This will integrate and use the potential of the Member States, reducing the negative impact on the functioning of the single market. Public support, in the form of subsidies and tax relief, should attract a multiple of financial contributions from private entities. Member States are able to cover up to 40% of investment costs in this way. Some of them have already prepared multi-billion euro financing, such as Germany with around €6 billion with the possibility to double the contribution soon. The EC is mainly interested in attracting investments from global leaders TSMC, Samsung, and Intel, which plan to invest more than €300 billion by 2030 in the development of semiconductor production capacities. The EC is also considering setting up a special investment fund for semiconductor development.

Potential Investments in the European Union

The EC and some Member States acting independently are in talks with the three major manufacturers—TSMC, Samsung, and Intel. The negotiations with Intel are the most advanced. The American manufacturer plans to compete with Asian competitors and significantly develop its production and technological capabilities. Moreover, it intends, following the example of its competitors, to produce chips not only of its own design but also as a contractor, according to the designs of other entities, such as car manufacturers. For this reason, its investment with a target value of €80 billion is to be located in Europe and primarily serve the automotive industry. The factory will be the most modern of its kind in the world. It is to use next-generation EUV machines (currently still under development by the manufacturer, ASML), which will reduce the size of the transistors by about a third. Intel intends to officially announce the selected investment locations in the coming weeks. Apart from this project, the U.S. company also plans to spend $7 billion to expand its existing factory in Ireland.

In the case of TSMC and Samsung, the talks are at a much earlier stage. In October 2021, Czechia, Lithuania, and Slovakia hosted a delegation of Taiwan’s National Development Council (NDC), its chairman, Minister Kung Ming-Hsin, and business representatives to explore investment opportunities in the region. Working groups are to be established between Taiwan and Czechia and Lithuania to continue work in this area. Potentially, a TSMC investment (probably of an R&D nature) could be the focus. Samsung’s reticent communication regarding its plans to build a new factory indicates greater interest in entering the European market by acquiring local manufacturers.

Possible Locations for Intel Investments

More than a dozen EU countries have declared their willingness to cooperate with Intel, submitting around 70 potential locations. The greatest chances were candidate sites in Germany, Ireland, and Poland. According to unofficial information, the factory will probably be built in Germany (Saxony), together with an R&D centre in France (Paris or Grenoble) and an auxiliary factory in Italy (Sicily). Experts point out that factors related to energy infrastructure: access to energy, the energy mix, and the low share of green energy worked against Poland. For Ireland, the impact of such investments on local public services and slow procedures probably eliminated it from contention. In Saxony’s favour also were access to a highly skilled workforce, high subsidies from the German government, proximity to automotive manufacturing, and existing infrastructure, including GlobalFoundries’ old AMD chip factories and others in the sector (Infineon, Bosch) forming Silicon Saxony—one of the five largest semiconductor clusters in the world. The candidacy of the UK, historically a natural place for expansion from a U.S. perspective, especially in technology, was rejected due to Brexit. Intel CEO Pat Gelsinger made it clear that investment in Europe must be located inside the EU single market.

Conclusions and Outlook

The location of Intel’s investment in the EU will significantly increase the chances of achieving the goals set by the European Commission. It may also set an example for establishing public-private partnerships and accelerate negotiations with other potential investors (TSMC and Samsung). In negotiations with TMSC, Czechia, Lithuania, and Slovakia will benefit from their assistance to Taiwan in combating the COVID-19 pandemic and from developing relations with Taiwan despite growing pressure from China to break them off.

The start-up of the Intel factory will go a long way towards securing supplies for the European economy, especially for the automotive industry, and will contribute to the development of the EU semiconductor sector. Due to the diversification of supply and control (e.g., legal) over the factory within the EU, it will also reduce dependence on foreign partners. The likely location of the investment in Germany, France, and Italy will not improve economic convergence of the Union; on the other hand, the proximity of Saxony may provide an opportunity for Polish businesses that could participate in the project as sub-suppliers and sub-contractors. From Poland’s perspective, it is also important to accelerate efforts aimed at the digital and energy transformations, which will increase the competitiveness of the Polish economy and improve the chances of attracting similar investments in future.