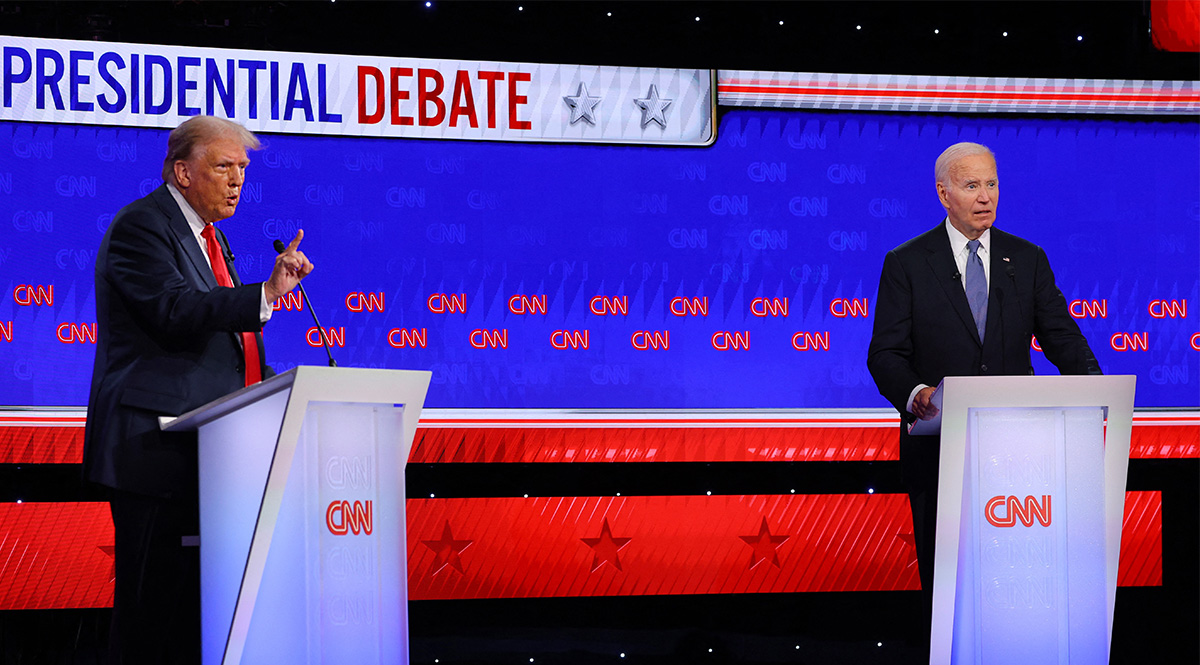

Bidenomics: U.S. Economy Tops Election Campaign Issues

The economy is one of the key topics influencing the outcome of the U.S. presidential election. Although under President Joe Biden, the economy has been improving since the pandemic and the economic consequences of the Russian aggression against Ukraine, this is not expressed by a public dealing with high product prices and costs of credit and housing, among other factors. The Biden administration is promoting the benefits to society as a whole of the reforms, under the collective brand “Bidenomics”. Republicans, however, argue that the president’s policy has led to increased inflation, in effect worsening the material situation of Americans. Failure to convince the public of economic improvements could make it more difficult for Biden to win re-election.

Pool/ABACA / Abaca Press / Forum

Pool/ABACA / Abaca Press / Forum

After the COVID-19 pandemic subsided, the U.S. economy gradually strengthened. GDP growth in 2021 was 5.9% (compared to a 3.5% decline in 2020), before slowing to 1.9% in 2022 as a result of rising energy prices and a downturn, including after Russia’s invasion of Ukraine. In 2023, GDP grew by 2.5%, including by as much as 4.9% in the third quarter and 3.4% in the fourth quarter, year on year. Although the economy continued to grow in the first quarter of this year, the 1.3% recorded was lower than last year’s average. The labour market is also in good shape. In the first year of Biden’s term (February 2021 to January 2022), average monthly job growth was 591,000, including as high as 939,000 in July and 860,000 in October 2021. In the second year, it remained high, averaging 396,000. This trend has continued, although the scale of job creation is smaller than immediately after the pandemic. Since February 2023, an average of 235,000 jobs have been added per month. This has kept unemployment low—since November 2021, it is in the range of 3.4%-4.1%, a return to the low unemployment recorded in 2019 just before the outbreak of the pandemic.

Since the beginning of Biden’s presidency, the U.S. has faced rising inflation, from 1.7% in February 2021 all the way up to 9.1% in June 2022 (the last time inflation was recorded at such a high rate was in 1981.) In the following months, it began to gradually decline, falling to the 3-3.7% range in June 2023 to present. The rise in inflation in the U.S. may have been influenced by, among other things, high public spending on pandemic relief programs by both the Donald Trump and Biden administrations. This was compounded by disruptions in supply chains and uncertainty in the fuel market after the Russian invasion of Ukraine. The economic situation has also been complicated by the Federal Reserve’s response to the jump in inflation and significant raising of interest rates, including the prime rate to 5.5% (the last time it was at that level was in 2001), which it has maintained since June 2023. These high rates translate into higher costs for leases and loans, including mortgages, indirectly affecting rental property prices.

The Balance of Bidenomics

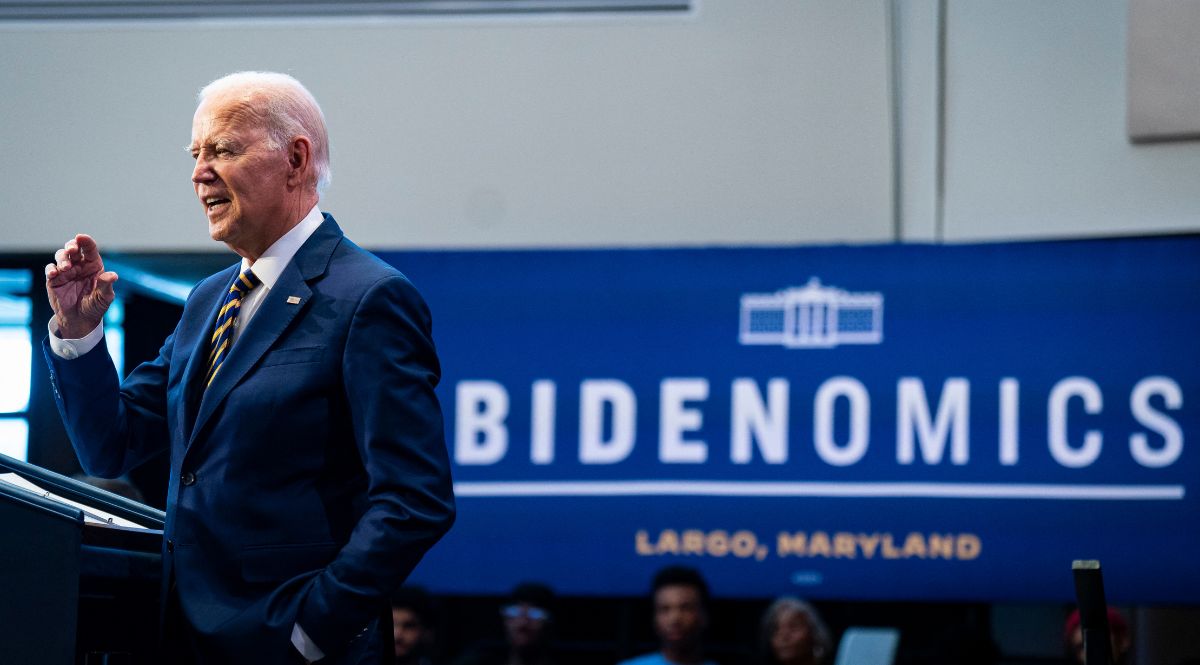

The beginning of the socioeconomic reforms comprising Bidenomics were the COVID-19 pandemic response and health and welfare reforms compiled in the American Rescue Plan passed by Congress in March 2021. Other significant bills were the Bipartisan Infrastructure Law, passed in November 2021, and the Inflation Reduction Act and the CHIPS and Science Act of August 2022. Bidenomics also consists of other decisions based on presidential executive orders. These include the introduction of a minimum wage ($15/hour) in federal workplaces, the partial or full cancellation of student debt, the improvement of labour rights (including the strengthening of unions), or the adoption of tax breaks of various categories.

“Bidenomics” appeared in the public space as a journalistic term, and only over time began to be used by the administration and the president’s election staff. In the course of the election campaign, “Bidenomics” became an official election slogan, used in press materials, promotional materials and speeches, including by the president himself. The decision did not meet with full support within the Democratic Party. This was due to concerns about the disparity between the improvement in economic statistics and public perception, as well as the building of propaganda for success based on the still unstable economic situation.

Bidenomics in the Optics of the Republicans

Bidenomics is also directly referenced by Republicans. It appears in their speeches and communiqués, and the conservative think-tank Americans for Prosperity maintains a well-positioned website dedicated to “the actual effects of Bidenomics”. According to Republicans, irresponsible fiscal policy and overestimated budget spending have led to the deterioration of the U.S. economy. They cite as their main argument the cumulative increase in the prices of goods and services during Biden’s term of office by almost 20% (cumulative inflation), including significant increases in fuel prices—heating oil by 44%, gasoline by 33%, and gas by 27%, as well as electricity by 29%. They argue that under Biden’s presidency, wages have not increased in real terms (i.e., adjusted for inflation) because the rate of increases has not been adjusted to the rate of price increases. They blame the president’s policies for the need to keep interest rates high (including mortgage rates in the 6.5%-7% range). They point to the increase in the national debt, particularly the Inflation Reduction Act, whose underestimated cost (by several hundred billion dollars) of renewable energy tax credits is likely to outweigh increased tax revenues, ultimately exacerbating the deficit rather than reducing it as originally envisioned.

Public Assessments of the Economy

Economic issues are traditionally considered by Americans as one of the most important areas of politics and have a key influence on their electoral decisions. Despite positive macroeconomic indicators, Americans’ opinions of the U.S. economic situation are overwhelmingly negative. In a survey conducted by the Pew Research Center in February this year, as many as 73% of those surveyed cited strengthening the economy as a priority area for the president and Congress. At a detailed level, a March survey by The Economist/YouGov cited inflation and price levels as the most important issue for 24% of respondents, the labour market situation and the state of the economy were cited by 8%, and fiscal policy by 5%. Other top issues cited included immigration (12%), climate protection (10%), healthcare (9%), and access to firearms (6%). The lowest support for Biden’s policies on economic issues was expressed by those citing inflation and prices (31%), while those citing fiscal policy and the labour market/economy was slightly higher at 33% and 38%, respectively. In the same survey, as many as 53% of respondents said the economic situation was worsening, while only 18% said it was improving. At the same time, 37% indicated that their personal material situation had worsened, while 15% said it had improved. Also in March this year, in a survey for CBS News, 59% of respondents rated the current economic situation as bad, while 38% said it was good. At the same time, Americans think that Biden’s policies no longer offer a chance for improvement, while they see such a prospect with Trump. Asked about their assessment of the economic situation from the time of Trump’s presidency, 65% said it was good, a bad state was indicated by 28% of respondents. In the same survey, 55% said Biden’s policies would lead to further price increases, while only 17% thought they would fall. In the case of Trump, 44% of voters indicated that his policies would lead to lower prices, while 34% thought there would be an increase.

Conclusions and Outlook

The state of the U.S. economy is gradually improving, thanks also to the set of ambitious acts and executive orders that comprise Bidenomics, but the mismatch between real wages and the persistently high prices of products and the increased cost of credit and rent makes this not felt by the public. Out of this comes unfavourable assessments of Biden’s economic policies, with voters focusing more on inflation and prices than on the state’s economic potential or even the labour market. Voters’ focus on these topics, despite the wide range of measures included in Bidenomics, will make it more difficult for the incumbent president to convince them of the benefits of his economic policies. Bidenomics is likely to have a greater presence in the campaign from the negative side, prompted by Republicans, who will use economic issues (connecting it also to migration) to court not only independent voters but also the Democratic electorate in politically undecided states (so-called swing states), such as Michigan.

The remaining four months until the election leave little prospect for an improvement in the perceived economic situation and, in this context, an increase in support for Biden’s economic policies. These issues will remain key for American voters (as will immigration and border protection), but the unpopularity of Biden’s policies in this area may prompt his campaign staff to put more emphasis on pointing out the dangers of Trump’s return to power. On the economic front, these will include the negative effects of the former president’s election promises, such as the imposition of across-the-board tariffs on all goods imported into the U.S. (of at least 10%), which could result in a renewed spike in inflation, and his calls for tax cuts for corporations and the wealthiest citizens.