Of the 25 Sub-Saharan African countries included in the Global Innovation Index (GII) for 2019, only seven were in the top 100 (South Africa and Kenya at the highest). Underinvestment in research and poor working conditions for scientists cause “brain drain”—the African Union estimates that 70,000 professionals leave the continent every year. This weakens the development potential of their countries of origin. Weak African economies are often based on the export of raw materials, which does not translate into an increase in the wealth of the inhabitants, and on small-scale subsistence farming. Most jobs pay some or all of the salary “under the table” (particularly certain groups, such as 90% of women) and about 38% of GDP in countries south of the Sahara comes from the grey or black markets, such as small street traders.

The same countries that ranked poorly in the overall GII often obtained higher scores for innovation efficiency—the rate of return with little investment in innovation (e.g., Tanzania in 2018 was 31st in efficiency compared to 92nd in the overall ranking). This shows the market potential for the development of new technology, especially in South Africa, Botswana, Mozambique, Kenya, Mauritius, and Rwanda. In Africa today, this market is known for its mobile payments, which developed there earlier than in Europe, partly because of the small number of individual bank accounts. Rwanda, host of the continent’s most important technology event, is building infrastructure for an African “Silicon Valley”—the $2 billion Kigali Innovation City. The project, which aims to attract tech companies, scientists, and investments, is hoped to generate profits of $150 million annually from technology exports.

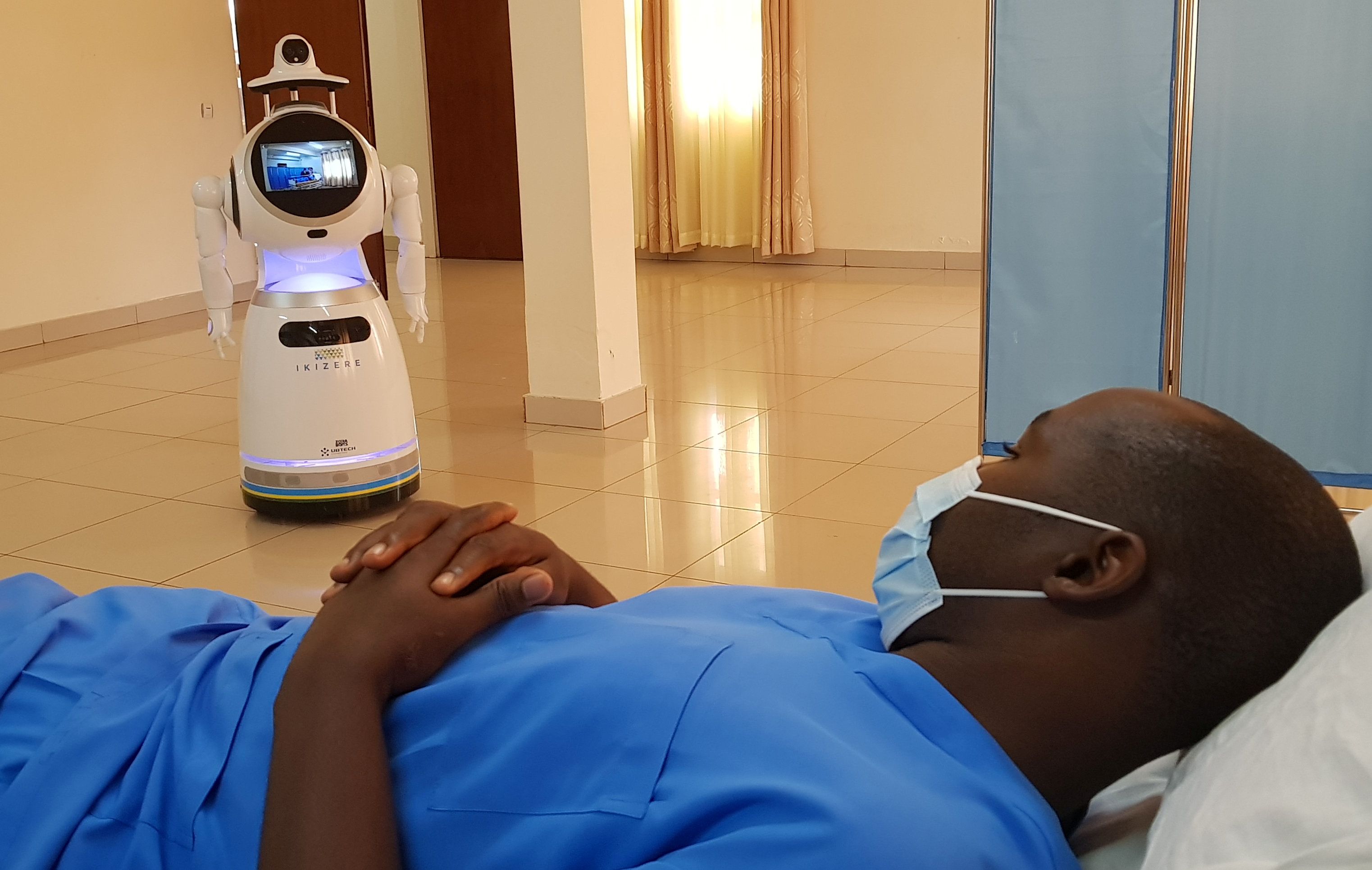

The Pandemic and New Technology

The spread of COVID-19 in Sub-Saharan Africa has highlighted the weaknesses of the local healthcare systems and anti-crisis capacities. Additionally, it was difficult to expect material aid from developed countries when they also struggled with shortages of equipment and medical resources and lacked experience fighting a pandemic (although they provided other types of support, such as reducing debt or delaying payments). These conditions forced rationing the limited resources and gave rise to a need for quick implementation of cheap, local solutions. Thus, governments saw potential in their own tech, engineering, and research and development sectors to fill gaps, reduce the risk of infection, and obtain substitutes for expensive imported equipment.

In some countries such as Rwanda and Ghana, technical and medical universities started developing prototypes and replacements for components for medical devices, which has allowed states to increase their inventories. Governments have become universities’ main customers, buying and generating additional demand for products and solutions created by local laboratories. Examples include Pharmol, a disinfectant developed at the University of Ghana's School of Pharmacy, and a virus-spread mapping tool from Wits University, South Africa. Universities also operate COVID-19 testing points (e.g., in Ethiopia, Ghana, South Africa).

Areas of Development

The main goal of African inventors is to improve the standard of living for local communities, so simple but impactful solutions dominate. The first field that spontaneously developed in many places was 3D printing of needed protective and medical materials. In Senegal, this has reduced the cost of respirators to around $60 apiece, compared to $16,000 for equipment imported from Europe. Masks and visors were also mass-produced by this method, including in Kenya, Benin and Malawi. This is controversial from the point of view of intellectual property rights, among other concerns, but the activity has increased with the availability of 3D-printing technology for other fields.

The need to avoid cash gave impetus to the acceleration of the development of the mobile payments market. For a while, it was most prevalent in Kenya, where around 27 out of 53 million people use the M-Pesa virtual currency, a product of the country’s largest mobile operator, Safaricom. As the pandemic struck Ghana, Kenya, Côte d'Ivoire, Mozambique, Uganda, and Zambia, the authorities have required mobile payment service providers to temporarily waive or reduce commissions, especially on small user-to-user transactions. At the same time, they made access to these apps easier, for example, in Ghana, which eliminated the requirement for additional registration before opening an account. Discounts at their own initiative are also offered by Nigerian (Paga) and South African (Yoco) startups in this industry, increasing their reach and winning the authorities’ favour. The pandemic has pushed a newly launched social support program in Sudan (balancing the abolition of fuel subsidies) to use electronic charge cards, which will cover 80% of families. Accelerating the digitisation of tax payments in the Republic of Congo has increased budget revenues and the transparency of public finances. It will also make embezzlement and exportation of state funds more difficult.

Local businesses are re-branching to help metropolises with water shortages cope with tightened sanitary requirements. In Freetown, Sierra Leone’s capital, Finic, formerly a farm machinery manufacturer, has established a network of public street sanitation facilities, and in Zimbabwe’s Harare, contactless refuse and decontamination services can be requested using the app. IT solutions are also developing to facilitate contact tracing. In Kenya, FebLab has developed Msafari, a tagging application for passengers of popular minibuses (matatu), to help identify people with whom the infected has had contact.

There is a growing market for deliveries of medical supplies to hard-to-reach places using drones. In Ghana, these services are run by Zipline, and last year the Australian company Swoop Aero entered DR Congo and Malawi and managed to reduce the average delivery time from three hours to 12 minutes. Due to the outbreak of the pandemic, the demand for these services and the experience of local staff, such as in Malawi, quickly increased. From the beginning of the pandemic, African innovation platforms including CcHub (Lagos / Nairobi), Zindi (Cape Town), and the WHO Regional Office for Africa initiated competitions and grants for engineers and companies for COVID-19-related solutions. This accelerated mobilisation of the scientific community and the exchange of experiences.

Perspectives

The recession that is starting to hit Africa, the first continent-wide one in 20 years, will be particularly acute in the poorest countries, whose citizens spend nearly all their current income and have no savings. Local small-scale manufacturers, services, and traders will suffer. The development of new technologies is not enough for countries to return to the path of growth. However, the pandemic has stimulated innovation and made governments realise their shared interests with the research sector. A model of cooperation is now established in which the authorities order and guarantee the implementation of socially useful solutions, and universities develop them. In the long term, greater state support for research, inventiveness, and the development of new technologies will favour innovative individuals and the structural transformation of economies. First of all, it will allow for accelerated industrialisation and production of processed goods, the lack of which forces the import of more expensive finished products, which has anyway decreased due to the limiting of trade with China. The launch of a production line of cheap coronavirus tests by the Senegalese branch of the French Pasteur Institute, expected in July, will be at least symbolically important. The psychological effect of favouring investments in domestic industry will also be strengthened by the completion of one of the largest refineries in the world in Nigeria in 2021, which will ensure the country’s self-sufficiency in gasoline production.

Many of the solutions being developed today to improve logistics and sanitation in cities, among others, will find support from supranational institutions after the pandemic passes. The importance and number of regional and international programmes supporting the implementation of new solutions, such as those developed by doctoral candidates from African technical universities (such as Conception X) or startups (e.g., through the Africa Prize for Engineering Innovation), will increase. Polish companies can benefit from the growing demand for innovation by establishing cooperation with local African producers or awarding committees, as well as universities interested in research cooperation.