Rosatom Goes Green: New Areas of Russia’s Foreign Cooperation

Rosatom’s Significance

State Atomic Energy Corporation Rosatom is one of the biggest Russian companies and is responsible for the country’s nuclear industry. More than 300 Rosatom subsidiaries work across the value chain of the nuclear industry, including uranium production and enrichment, fabrication of nuclear fuel, nuclear power plant design, construction, and decommissioning, and nuclear fuel utilisation. Rosatom has about 250,000 employees, making it one of Russia’s biggest employers and taxpayers, and in 2017 it generated around 19% of electricity in Russia. The corporation also works on nuclear weapons for the Russian military.

Rosatom is one of the global leaders of the nuclear industry. It has 36% of the uranium enrichment market, 13% of global production, and the second-biggest uranium reserve in the world. According to 2016 data, in Rosatom’s 10-year portfolio shows the company has orders for construction of nuclear power plants in 12 countries (including EU members) worth nearly $100 billion. These multi-billion-dollar investments are spread over many years, making the contractors dependent on Russian technology and state loans and construction agreements, signed as inter-governmental agreements. That allows Russia to strengthen its influence, especially in countries that need Russian financial support to build a nuclear power plant.

Pivot to Renewables

Despite such a strong position in both the domestic and international markets, Rosatom’s strategy aims to generate a minimum of 30% of its revenue from new products by 2030 (up from 17% in 2016). Among the reasons for this goal is the growing popularity of energy sources that compete with nuclear: more efficient wind turbines and the lower cost of photovoltaic panels. This trend is exerting pressure on Rosatom, despite the company’s new contracts in Africa and the Middle East. Moreover, Rosatom wants to benefit from the global “green energy” trend since it has the technological potential to use in this sector.

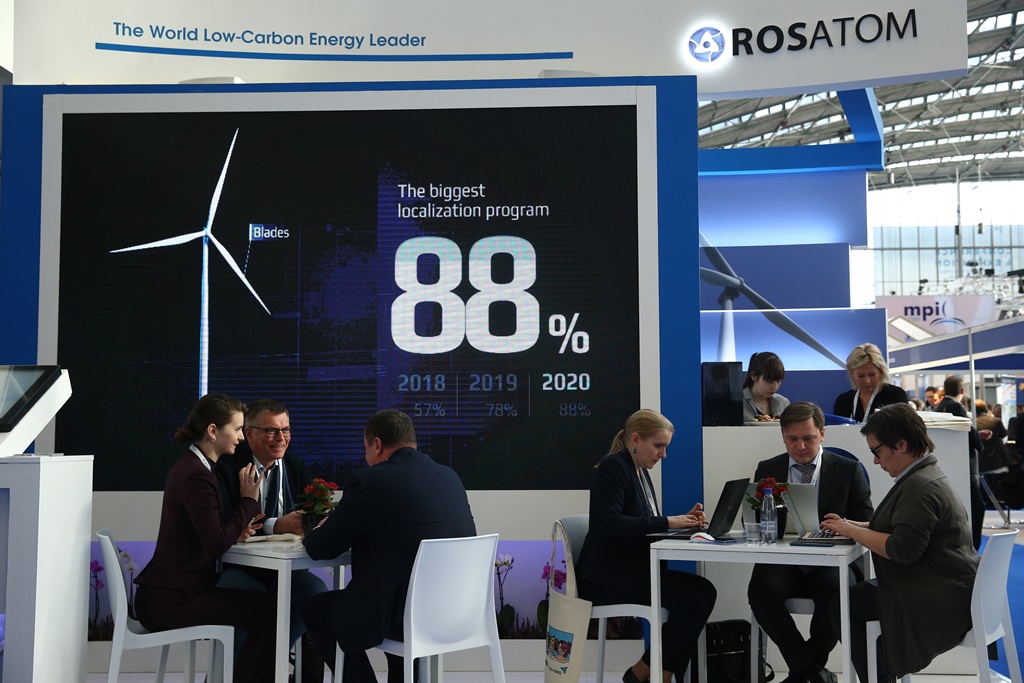

Russian authorities also recognise the dynamic growth of renewables all over the world, which could decrease the demand for Russian resources in the long run. Rosatom’s goals are convergent with the government’s ambitions to develop renewables in Russia (where, beside hydroelectricity, the production of energy from renewables is marginal). In recent years, the Russian government launched a tender for the construction of wind and solar plants. Russian authorities also want some of the equipment to be manufactured locally to support job creation and the government’s aim to develop innovative technologies.

Rosatom: “Green Energy” Potential

The company is currently gaining its experience in renewables thanks to domestic investments. In the last two years, Rosatom’s subsidiaries won the tenders for wind farm construction in Russia with almost 1 GW capacity (to compare, at the end of 2016 Rosatom’s nuclear generating capacity was 27.1 GW). According to Rosatom’s forecasts from 2016, in 10 years wind energy will account for 11% of the company’s revenue. The company also has experience in producing polycrystalline silicon, used in solar panel production.

In 2016, Rosatom revenues stood at more than RUB 864 billion (around $15.3 billion, or 5.3% higher, year on year). In recent years, the company has spent around 4.5% of its revenues on research and development and wants to keep the spending on this level until at least 2020. Rosatom also works on energy storage technology, which will be important for securing energy supply stability and is crucial for electric car development.

The company also aims to create the capacity to produce lithium-ion batteries, crucial for electric vehicles, and to cooperate with vehicle manufacturers. It is not clear whether electric vehicles will become popular in Russia, but the market potential is recognised by other state companies that could collaborate with Rosatom in the future. One of them, Rostec, and its subsidiaries (including AvtoVaz) are developing electric buses and electric vehicles. Moscow local authorities want all newly introduced buses in the city from 2021 to be electric, and charging stations created not only in the capital but also in Saint Petersburg. State firm Rosseti, one of the biggest electric grid operators in the world, announced in 2015 its goal to create 1,000 charging points in Russia by the end of 2018. In 2017, Rosseti signed an agreement with St. Petersburg authorities and Renault Russia to create charging stations in St. Petersburg.

Rosatom is also the only Russian company (through its subsidiaries) producing lithium products, a mineral crucial for lithium-ion batteries. The Russian company is looking for new lithium sources to help it strengthen its position as the popularity of electric vehicles grows. Rosatom plans to open a lithium mine in Zabaykalsky Krai, East Siberia. It also aims to get involved in lithium mining projects in the top producing countries or to strengthen economic ties with them: Australia, Chile, and Argentine. Rosatom bids on lithium projects in Chile and has signed a memorandum of understanding (MoU) on a flake-graphite project with Australian Magnis Resources. The Australian company has plans to dynamically enter the lithium-ion battery market. Cooperation with Rosatom could then broaden in the future. On the other hand, strengthening economic relations with Argentina could help Rosatom gain access to the country’s lithium resources in the future. Rosatom wants to build a proposed nuclear power plant in the country and Russia and Argentina have signed an MoU on uranium exploration and production. And it is worth noting that Rosatom has established a trading company in Switzerland to trade lithium (and possibly other resources used in electric vehicle construction).

Outlook

Rosatom, like other energy companies, recognises global trends such as the growth of renewables and electric vehicles and adjusts its long-term strategy to meet them. Thanks to its experience across the nuclear industry value chain, the Russian company can offer attractive deals on the construction and operation of nuclear power plants for developing countries that want to invest in this type of power generation (in the coming decades, it is excepted that nuclear investments will be concentrated outside OECD countries). On the other hand, by entering the “green energy” business, Rosatom in the long run will be able to compete with developed countries on their markets as they abandon nuclear energy and develop “clean” technologies at the same time, mainly renewables and electric vehicles.

Cooperation in the clean energy sector and on modern technology (developed by state companies) could be an important tool in Russia’s foreign policy. It would allow the country to strengthen cooperation in new, promising sectors. Access to some of the resources important for renewables and electric vehicles could be an important advantage for Russian companies. It is worth mentioning that Russia not only has oil and gas reserves but key green energy resources such as cobalt, copper, and nickel, which can help both Rosatom and Russia in the future. If the company is successful with its strategy, there is the possibility of strengthening Russo-German cooperation to balance against the dominance of the U.S. and Asian leaders in the renewables and electric vehicle sectors.